EUR/USD was hit by Draghi’s dovishness but when things get quiet, it manages to stabilize and recover. What’s next?

Here is their view, courtesy of eFXnews:

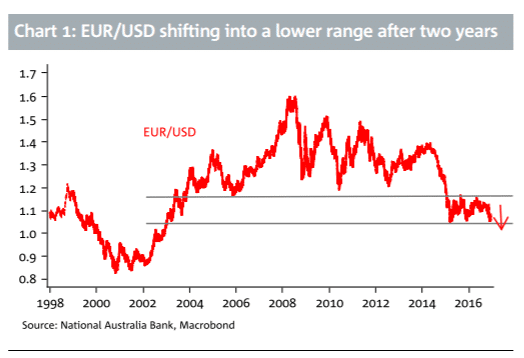

A chart of EUR/USD for the last two years is instructive in that it reveals the pair traded in a tight 1.05-1.15 range; a remarkable period of stability and one not seen during the single currency’s lifetime until now. Of course this sideways move followed a 25% or so slide in the EUR during 2014 as the ECB moved into QE and the USD started its own 25% rise against a number of major and EM currencies. Even still with Brexit, Trump, a Greek and (now brewing) Italian crisis, EUR/USD’s steady state is notable.

From a big picture perspective and as we gaze into 2017, we assume with some conviction that if EUR/USD could not sustainably rise above 1.15 during that period, then with the Fed set to hike rates as the US economy moves closer to employment and inflation targets and as the Trump presidency opens up a whole slew of further potential USD positives, while the ECB will be buying bonds at least until end 2017, there is little chance of 1.15 being breached anytime in the coming months either. The broad USD of course has already risen by 4% since Trump’s victory, in anticipation of possible increased fiscal spending, tax cuts, repatriation flows and attendant hawkish Fed response, but there could be more gas in the tank here for the USD, once the President-elect gets into office and pushes for some ‘easier’ wins. Caution is evident though with the USD off its peak as investors ponder potential trade spats or difficulty in passing pre-election pledges.

For EUR/USD the Trump election victory has been the only development in a year capable of forcing the pair down through levels of support around 1.10 and 1.08 to the range bottom at 1.05. To be fair, the prospect of European political turmoil thanks to anti-establishment and populist backlashes – emphasised by the Trump result following Brexit – have pulled support from the EUR too. The range for EUR/USD then looks to have shifted lower and whatever we think of European politics and the ECB, the 1.08-1.10 area now looks like a top.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The ECB’s APP changes come against an improving economic outlook now absent deflation risks. We aren’t convinced the ECB should need to be buying bonds at the rate of EUR60bn per month past September 2017 (the latest commitment is through end-2017) but understood that against the present political backdrop, it had to deliver a dovish message. The shift to be able to buy lower tenor bonds and those yielding below the -0.4% deposit floor is ‘an option, not a necessity’ – which we take to mean may only be used if yields generally fall amid an economic slump or a failure of longer-term yields to rise, negating a steepening curve that aids the banking sector. But these are issues for later in 2017 and for now investors at large, it seems, see the ECB’s actions as newfound reasons to be bearish.

Thus we continue to look for a decline in EUR/USD to 0.98 end Q1, though H1 may be more apt in a new 0.98-1.08 range.

*NAB maintains a short EUR/USD in its portfolio targeting 0.98, with as top at 1.09.