EUR/USD is on the rise once again, extending the recent gains and reaching the highest levels during the month of April, reaching a high of 1.0747.

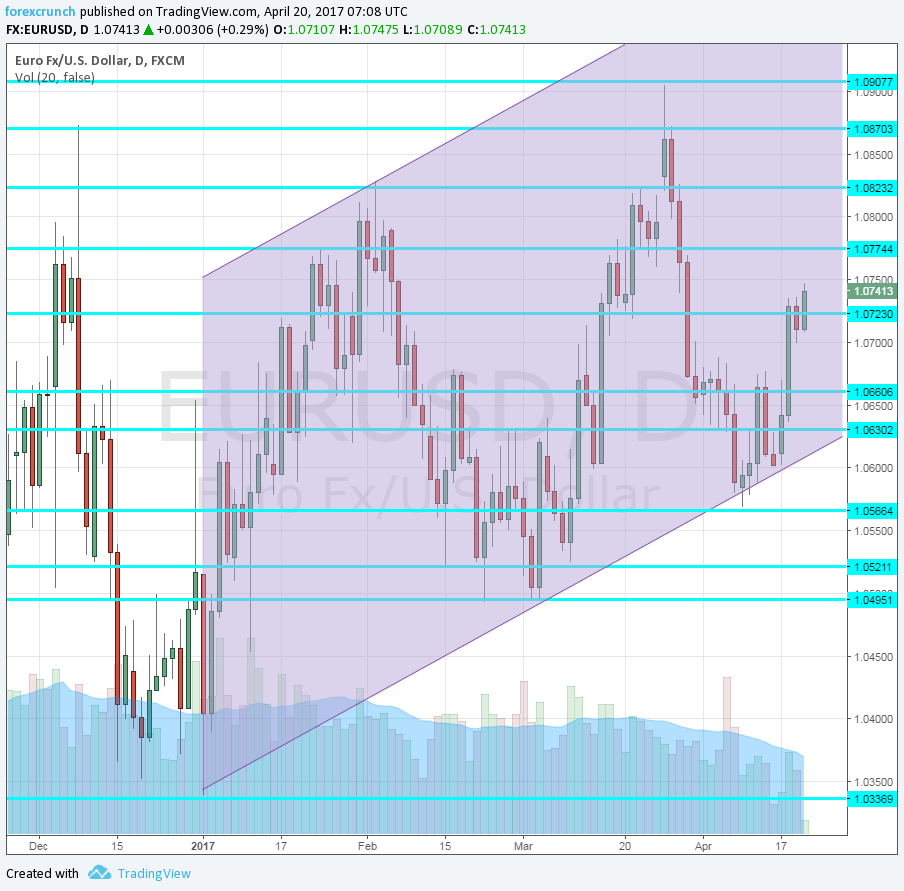

These recent gains are an extension of the bounce within the uptrend channel. Further resistance awaits at 1.0775 and 1.0830.

Why is EUR/USD rising?

Looking at other charts, it is easy to see that the US dollar has resumed its falls after a correction and an attempt to recover. US yields remain depressed and this does not help the greenback. The ongoing theme is a disillusion from Trump: the grand plans for tax cuts and infrastructure spending seem unrealistic.

But the euro also enjoys a favorable poll by Harris Interactive. The poll gives Macron 25%, and in this case with a more significant lead on Le Pen with 22%. Macron advanced one point in comparison to the previous poll.

Both Fillon and Melenchon are behind with 19%. In theory, radical-left Melenchon has a rough road to meet Le Pen in the second round. This is the nightmare scenario that is scaring markets.

In the second round, this poll by Harris puts Macron at a clear victory against Le Pen, with 66% support. The centrist is also expected to beat the other two candidates. Fillon would beat Le Pen with 58% support and also Melenchon would beat Le Pen, but that would be a small consolation: he is not market friendly.

Macron and Fillon are the favorite candidates for markets.

EUR/USD

The chart below shows the rise within the uptrend channel. The world’s most popular currency pair enjoyed higher lows since January.

More: French elections – all the updates in one place