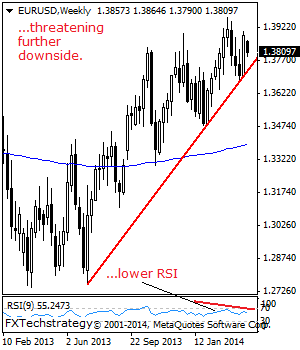

EURUSD: With the pair closing lower the past week, a continuation of that weakness is envisaged in the new week. Support lies at the 1.3779 level where a break will aim at the 1.3737 level followed by the 1.3676 level.

Further down, support stands at the 1.3600 level where a violation will target the 1.3550 level. Its daily RSI is bearish and pointing lower supporting this view. Conversely, medium term outlook on EUR remains higher but will have to recapture the 1.3966 level to annul its present bear pressure.

Further out, resistance resides at the 1.4000 level, its big psycho level. All in all, EUR remains biased to the upside in the long term but faces corrective weakness threats.

Guest post by FX Tech Strategy