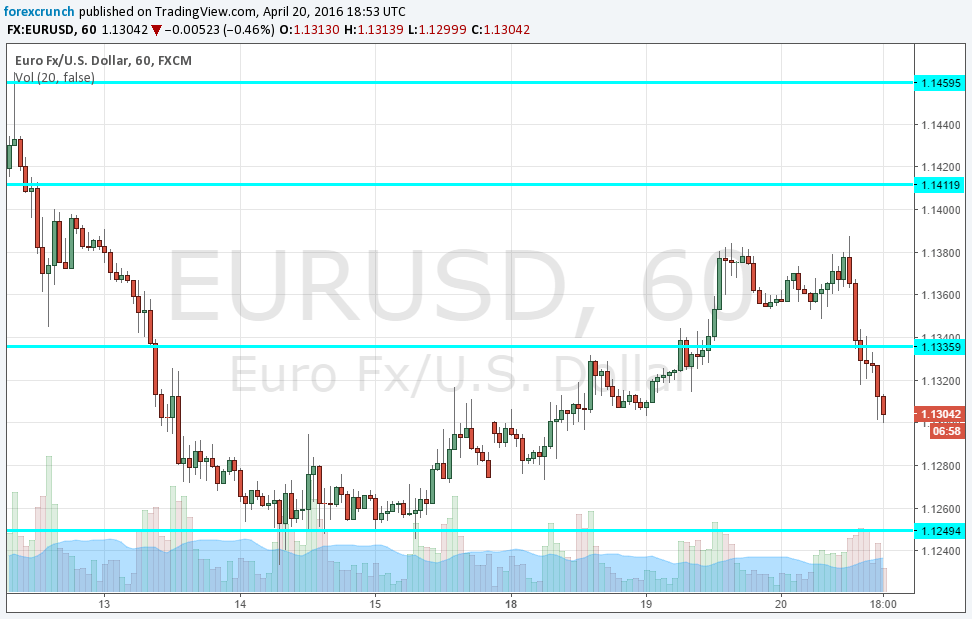

Perhaps traders are afraid of helicopter hints or perhaps it’s profit taking on previous gains. In any case, EUR/USD is now sliding to 1.13, back under the 1.1335 that worked as a separator of ranges.

In the past meetings, we have seen the anticipation for some ECB action result in a weaker euro, but eventually this was followed up by a surge of the common currency. Even when Draghi delivered in March, and he certainly beat market expectations in terms of the size of the stimulus package, the talk about not doing more served as a trigger for a shot up in the pair.

Will recent history repeat itself? Or have the tables turned against the euro?

The euro may be returning to a safe have role and in this case, it is sold off as there is no demand for safety. Also the yen is following suit while commodity currencies are still looking good against the greenback. At least at this point, it is hard to say that this is a greenback comeback. The move is limited to these major currencies.

The pair is within the 1.1250 to 1.1335 range. Further resistance awaits at 1.1410, followed by 1.1460. Support awaits at 1.1250, 1.1215 and finally 1.1150. In comparison to quite a few other currency pairs, EUR/USD has been frustratingly stable.