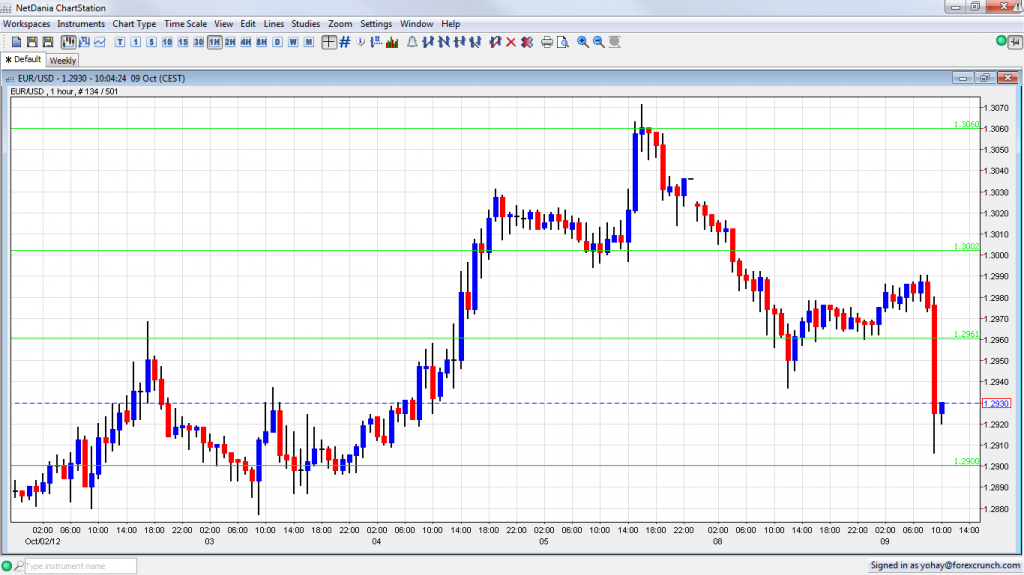

EUR/USD bounced after falling sharply and countering low support. The main trigger for the fall was a statement by Spain’s finance minister that could be interpreted as if the country is not hurrying to ask for a bailout.

Additional risk factors aren’t helping a recovery. Will the pair break even lower?

EUR/USD already managed to climb nicely and seemed to hold on to high support in the European session, but as European traders walked in, the Spanish finance minister Luis de Guindos said that Eurogroup did not discuss further adjustments and that it valued Spain’s measures so far positively.

So, if Spain already did what needs to be done, a bailout isn’t that close. A totally different statement was heard last week by Spanish deputy PM Soraya Sáenz de SantamarÃa who said the bailout is a question of “when” and not “if”.

After the statement from de Guindos, 10 year Spanish bond yields leaped by 35 basis points. Stock markets followed.

The round number of 1.29 served as support last week and also as resistance beforehand. Further support is found at 1.2814. Weak resistance is at 1.2960 and stronger resistance is at 1.30.

Attempts to break higher or lower have been limited. For more on the euro, see the EUR/USD forecast.

Additional risk factors are in abundance:

- Angela Merkel is visiting Athens and no less than 7,000 security personnel are dispatched.

- Negotiations between the troika and the still stuck. The new deadline is October 18th.

- ECB President Mario Drgahi is talking about systemic risk.

For more on the current situation in Greece, see Greek Crisis: Systemic Can Kicking