Euro dollar rallied up to higher resistance at the beginning of the new week. Greece passed the austerity bill in parliament with a big majority, yet the main opposition party said it would renegotiate the terms after the elections. This casts a shadow on the upcoming German approval of Greece’s second bailout program. The saga continues, in a week that features worrying GDP figures.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

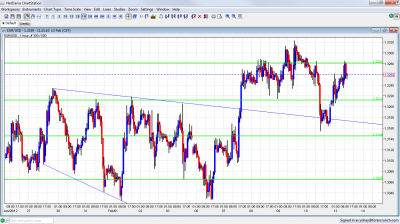

EUR/USD Technicals

- Asian session: An active session sees the pair jump above 1.3212, which it lost on Friday.

- Current range: 1.3212 to 1.3280.

- Further levels in both directions: Below: 1.3212, 1.3145, 1.3060, 1.30, 1.2945 and 1.2873.

- Above: 1.3280, 1.3333, 1.3450, 1.3550 and 1.3650.

- 1.3280 remains a battle line and it served as a bouncing spot now.

- 1.3212 is weaker support now, as 1.3145 strengthens.

Euro/Dollar higher after Greek vote- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German WPI. Exp. +0.2%. Actual +1.2%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Chaos in Athens: The Greek parliament approved the new austerity bill by 199:74 after a long and dramatic discussion in parliament. The government said it is making a difficult choice to prevent bankruptcy. The opposition hinted that Greece will be bankrupt anyway. The interesting thing is that main candidate for leading the government after April’s elections, Antonis Samaras, said that the measures that were just approved will likely be renegotiated after the elections. All this happened while protest were raging in Athens, with over 40 buildings burning.

- Ball Passes to Brussels: Amid this mess, Wednesday’s Eurogroup meeting is supposed to to approve the deal. The statement from Samaras is likely to echo strongly. German finance minister Wolfgang Schäuble, said that ¨Greek promises are not enough”, after so many have already been broken in the past. Greece still has to find 325 million euros of cuts until this meeting. The situation remains fragile.

- Successful Italian auction: Italy managed to raise 12 billion euros, and got better yields. Looks like banks are gearing up towards the next LTRO by the ECB, planned for February 29th.

- Recession looming: GDP figures published on Wednesday will likely show that the euro-zone contracted in Q4. This also includes Germany. For Italy, it will likely be the second quarter of contraction in a row, making it an official recession. Note that Japan posted a deep contraction in Q4, and this doesn’t bode well for Europe.

- ECB opens door to Greek haircut: The pressure for Official Sector Involvement succeeded. Mario Draghi made a “one more thing” last moment Steve Jobs style statement and opened the door to a contribution by the ECB to the Greek bailout. But this depends on politicians first.

- Portugal awaits Greece: Portuguese yields remain on high ground. The path chosen for Greece will likely be followed by the small Iberian country in the infamous “contagion” effect that is feared.

- Bernanke dismisses job growth: The drop of the unemployment rate to 8.3% and the gain of 243K jobs in January gave a lot of hope for the US. Nevertheless, in a testimony in Washington, Ben Bernanke dismissed the positive figure. He mentioned the employment-to-population ratio and said that 8.3% understates the real state of unemployment, which he sees as quite gloomy. So, QE3 still has a chance in March, even if quite low. Jobless claims fell once again to 358K, but in another speech today, Bernanke will likely continue his soft stance. The meeting minutes are awaited on Wednesday. They will show how dovish the FOMC is.