Euro dollar is trading in a downtrend channel as the pressure on Greece continues. A video conference replaces today’s planned Eurogroup meeting, and the second bailout is expected to be approved only on Monday. Initial GDP figures for the euro-zone came out better than expected and helped the pair stabilize. Today we’ll get to see the tendency towards QE3 in the US.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: Another active session saw the pair rise on new Chinese promises for aid. This faded away.

- Current range: 1.3145 to 1.3212.

- Further levels in both directions: Below: 1.3145, 1.3060, 1.30, 1.2945 and 1.2873.

- Above: 1.3212, 1.3280, 1.3333, 1.3450, 1.3550 and 1.3650.

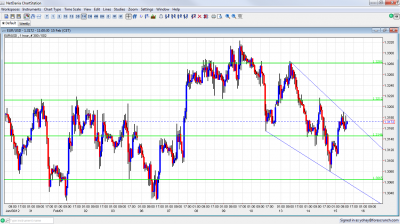

- Note the downtrend narrowing channel on the hourly chart.

- 1.3280 worked as tough resistance and marked the beginning of the fall.

- 1.3145 is weaker once again. 1.3060 is the stronger line beneath.

Euro/Dollar in downtrend channel – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:30 French GDP. Exp. -0.2%. Actual +0.2% – This positive surprise doesn’t help the euro.

- 7:00 German GDP. Exp. -0.3%. Actual -0.2%.

- 9:00 Italian GDP. Exp. -0.6%. Actual -0.7%. Italy is officially in recession.

- 10:00 Euro-zone GDP. Exp. -0.3% – 0.4%. Actual -0.3%.

- 10:00 Euro-zone trade balance. Exp. 3.5 billion. Actual 7.5 billion.

- 13:30 US Empire State Manufacturing Index. Exp. 14.7 points.

- 14:00 US TIC Long-Term Purchases. Exp. 45.4 billion.

- 14:15 US Industrial Production. Exp. +0.7%.

- 14:15 US Capacity Utilization Rate. Exp. 78.6%.

- 15:00 US NAHB Housing Market Index. Exp. 26 points.

- 19:00 US FOMC Meeting Minutes. How dovish is the Federal Reserve?

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Milder recession: According to the initial release, the French economy surprised and continued growing. It’s important to note that Q3’s growth was revised tot he downside. And while Germany suffered contraction, a return to growth has good chances in Q1, so an official recession will likely be avoided.

- Brussels taking its time: The planned Eurogroup meeting that is supposed to approve the deal was postponed to Monday. A video conference will be held today instead. German finance minister Wolfgang Schäuble, said that ¨Greek promises are not enough”, after so many have already been broken in the past. Greece still has to find 325 million euros of cuts until this meeting. The situation remains fragile.

- Compliance in Athens: The main candidate for leading the government after April’s elections, Antonis Samaras, said that the measures that were just approved will likely be renegotiated after the elections. He’s probably looking at the polls. Under pressure, Samaras will likely sign the pledge today.

- Chinese promises: The usual ritual continues – when Chinese officials meet US/European ones, they say the things that their counterparts want to hear. This good diplomacy isn’t followed by action. China is ready to put money into Europe, but they prefer hard assets over bonds.

- Moody’s downgrades: The rating agency didn’t downgrade France as S&P did, but it act on Italy, Spain and 4 other euro-zone countries. This follows downgrades to Spanish banks by other agencies yesterday. At least the LTRO keeps their bond yields relatively stable.

- ECB opens door to Greek haircut: The pressure for Official Sector Involvement succeeded. Mario Draghi made a “one more thing” last moment Steve Jobs style statement and opened the door to a contribution by the ECB to the Greek bailout. But this depends on politicians first.

- Portugal awaits Greece: Portuguese yields remain on high ground. The path chosen for Greece will likely be followed by the small Iberian country in the infamous “contagion” effect that is feared.

- QE or not QE?: The drop of the unemployment rate to 8.3% and the gain of 243K jobs in January gave a lot of hope for the US. Nevertheless, in a testimony in Washington, Ben Bernanke dismissed the positive figure. He mentioned the employment-to-population ratio and said that 8.3% understates the real state of unemployment, which he sees as quite gloomy. So, QE3 still has a chance in March, even if quite low. Jobless claims fell once again to 358K, but in another speech today, Bernanke will likely continue his soft stance. The meeting minutes are highly anticipated. They will show how dovish the FOMC is. In the meantime, polls show that the mood regarding the economy is improving in the US.