Euro dollar started the new week with a slide that turned into a sharper fall, as the standoff in Athens continues. The troika has a non-negotiable list of demands pending a deadline at 10:00 GMT and Greek politicians are finding it hard to bring it to voters. There are doubts that this deadline is real, but no doubt that Greece is in dire straights. Will we see further falls now? Update from Athens: there is no deadline, but the euro remains pressured.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

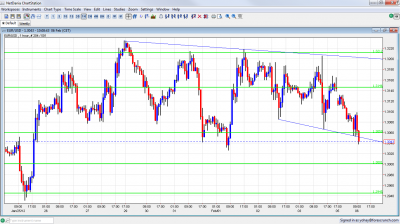

EUR/USD Technicals

- Asian session: A very active session saw a Sunday gap under 1.3145 and a deterioration since then. The break below 1.3060 began in the European session.

- Current range: 1.30 to 1.3060

- Further levels in both directions: Below: 1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623

- Above: 1.3060, 1.3145, 1.3212, 1.3280, 1.3333 and 1.3450.

- Note the downtrend support line which was only a temporary cushion.

- Serious support is only at 1.2945. The round number of 1.30 isn’t strong.

- 1.3212 proved to be a strong cap.

Euro/Dollar weighed by the Greek deadline- click on the graph to enlarge.

EUR/USD Fundamentals

- 9:30 Euro-zone Sentix Investor Confidence. Exp. -14.8 points. Actual -11.1 points.

- 11:00 German Factory Orders. Exp. +0.7%. Actual +1.1%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Standoff in Athens: The EU / ECB / IMF troika demands a cut tot he minimum wage and many more demands from Greece, in a non-negotiable manner. A deadline for Sunday evening has been extended to Monday noon. Greek PM Papademos has been in intensive talks with political leaders to accept the deal, but without success. Elections are awaiting Greece in April (for now). A general strike is planned for Tuesday. The troika prevents Greece from signing off the PSI talks before these reforms are agreed upon – a condition for the second bailout. It’s either an orderly default with harsh austerity or a disorderly default and potential departure form the euro. The euro-zone lost patience with Greece, and Greeks lost patience after years of recession. How will this end?

- Portugal awaits Greece: Portuguese yields remain on high ground. The path chosen for Greece will likely be followed by the small Iberian country in the infamous “contagion” effect that is feared.

- Excellent US job data lowers chance of QE: The drop of the unemployment rate to 8.3% and the gain of 243K jobs in January provide a lot of hope for the US and might chance the course of the Federal Reserve, which hinted on another round of dollar printing. This helped commodity currencies but hurt the euro. This stands out as Greece deteriorates.

- ECB Pressured to take a haircut: This seems to be the sticking point, after the Private Sector Involvement has been mostly agreed upon. More and more speakers call for the ECB to take a hit on Greek bonds, despite the “no bailout” clause in the EU Treaty. The pressure comes from the banks (naturally) and also from the IMF. Note that ECB president Draghi didn’t categorically reject this. If Greece defaults, the ECB will have a 100% involuntary haircut.