EUR/USD had a positive week, rising on the back of USD weakness. Are more rises on the way? The upcoming week features PMIs and another important German survey. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

According to ZEW, economic sentiment has improved, but remains finely balanced, with Brexit fears still lurking. In the US, the Fed’s minutes showed that only a small minority wants a hike, while the vast majority wants to wait and wait. This resulted in another bout of dollar weakness, extending previous losses.

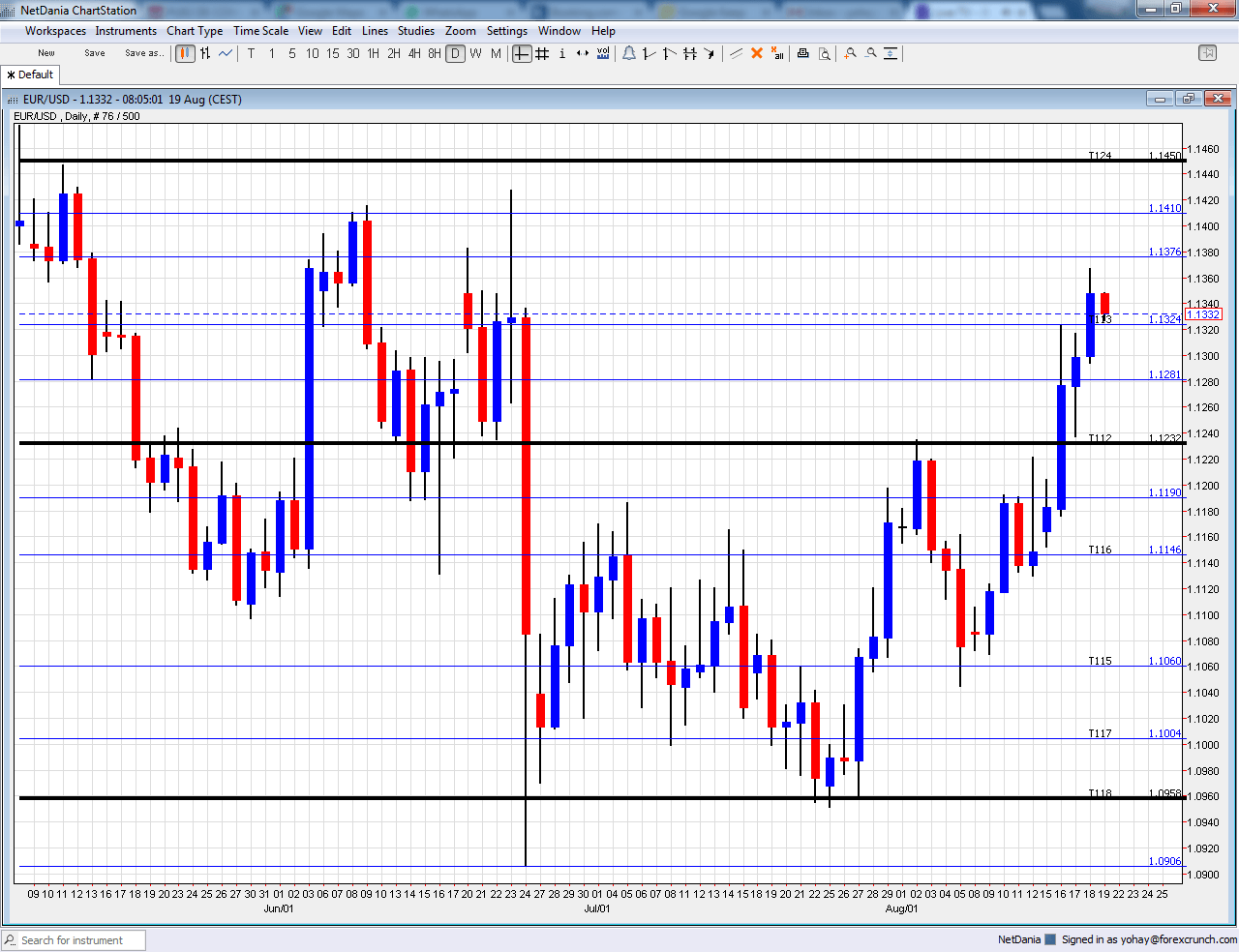

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Flash PMIs: Tuesday morning: 7:00 for France, 7:30 for Germany and 8:00 for the euro-zone. Markit continued showing a contraction in the French manufacturing sector in July, with a score of 48.6 points. This is below the 50 point threshold that separates expansion from contraction. A small rise to 49.1 points is expected. The services sector scored 50.5 points and a minor rise to 50.6 is predicted. In Germany, the continent’s largest economy, both sectors were growing. Manufacturing saw 53.8 points and a score of 53.7 is now projected. Services 54.4 according to the final numbers and 54.3 is now forecast. The whole euro-zone scored 52 and 52.9 for manufacturing and services respectively and both are expected to tick up 0.1% each.

- Consumer Confidence: Tuesday, 14:00. Consumer confidence remained negative in the euro-zone with a score of -8 points in July. The figure for August will likely be identical: -8 points.

- German Final GDP: Wednesday, 6:00. According to the initial report, the German economy grew by 0.4% in Q2 2016, slightly better than expected. The figure will likely be confirmed now.

- Belgian NBB Business Climate: Wednesday, 13:00. The extensive survey from this small country serves as a barometer for the whole euro-area. A positive score of 1 point was seen in July. 1.1 is forecast now.

- German Ifo Business Climate: Thursday, 8:00. Germany’s No. 1 Think Tank showed substantial confidence among businesses with a score of 108.3 in July. This was different than ZEW which showed a drop in confidence due to Brexit. ZEW has since shown a bounce for August. Will IFO follow? A print of 108.5 is projected.

- German GfK Consumer Climate: Friday, 6:00. Consumers have been gradually feeling better according to this survey, with the score rising to 10 points. Consumer confidence implies future spending, but the data are not always correlated. An advance to 10.2 is estimated.

- Monetary data: Friday, 8:00. The ECB reports the change in money circulation, M3 Money Supply, and growth of private loans. Back in June, M3 Money supply advanced at an annual pace of 5% while private loans grew by 1.7%. M3 carries expectations for a repeat of 5% while private loans are predicted to accelerate to 1.8%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made a clear break above the 1.1230 line (mentioned last week) and continued higher.

Technical lines from top to bottom:

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1410 capped the pair in early June. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the bottom bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and worked as resistance.

1.1190 is the post-Brexit high seen in July. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0905 is the swing low seen in June and serves as a weak support. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I am neutral on EUR/USD

In the ugly contest between the greenback and the euro, the euro had the upper hand. The gains could be consolidated now.

Our latest podcast is all about the Fed’s forecast failures.