EUR/USD had another fantastic week, reaching the highest levels since early 2015, but it gave up most of the gains late in the week. Trade figures are the highlights of the upcoming week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone headline inflation remained stable at 1.3%, but headline inflation surprised to the upside with 1.2%, providing support to the common currency. GDP growth clocked 0.6% for the second quarter in a row. In the US, the chaos at the White House significantly contributed to the downfall of the greenback, but the NFP report was good enough to trigger a bounce back on the US dollar and EUR/USD finally made a meaningful correction still ending the week on a higher note. All in all, EUR/USD has 5 reasons to rise.

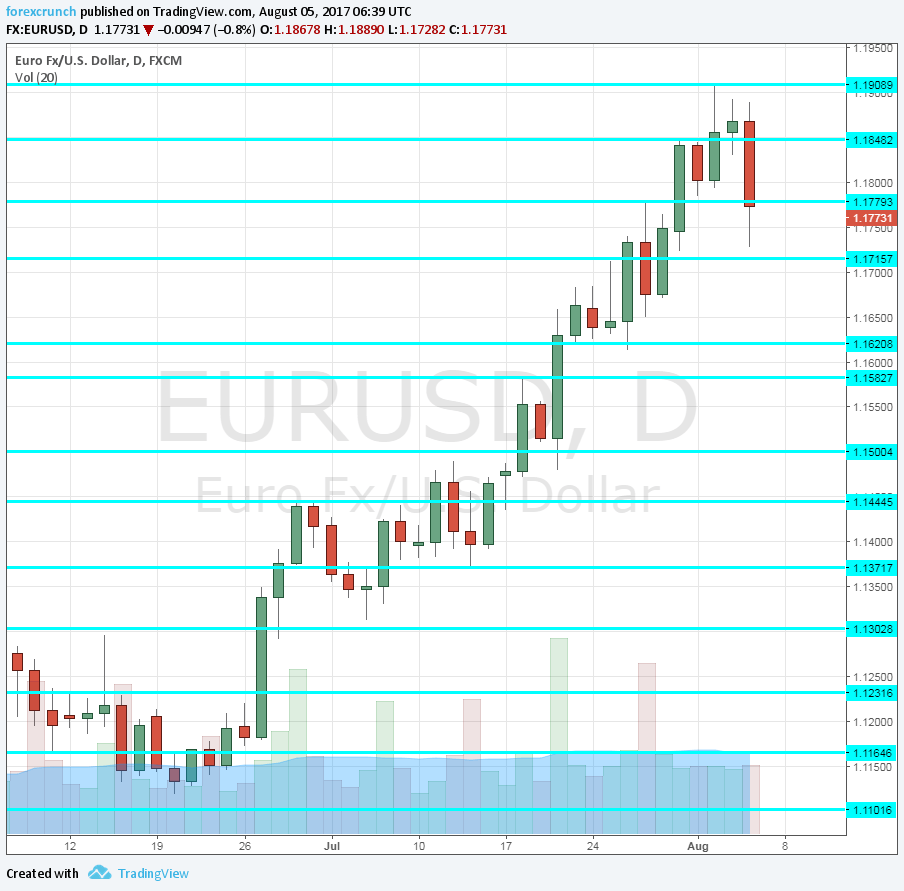

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Industrial Production: Monday, 6:00. Germany, the locomotive of the euro-zone, enjoyed a significant rise in industrial output back in May: 1.2%. Will we see a correction now? A modest rise of 0.2% is on the cards.

- Sentix Investor Confidence: Monday, 8:30. This 2800-strong survey has been on the rise, but stalled back in July with 28.3 points. A resumption of the gains is on the cards now. A minor drop to 27.8 is predicted.

- German Trade Balance: Tuesday, 6:00. The No. 1 economy in Europe has a massive trade surplus, a factor that keeps the euro bid. This surplus stabilized at 20.3 billion in May. An advance to 22.3 billion is predicted.

- French Trade Balance: Tuesday, 6:45. The second-largest economy in the euro-zone has a chronic deficit, yet this deficit narrowed to 4.9 billion in May. A wider deficit of 5.1 billion is on the cards.

- French Industrial Production: Thursday, 6:45. The French economy is picking up the slack, with a big bounce in industrial output back in May: 1.9%, exceeding Germany’s pace. This time, a drop of 0.6% is predicted.

- German inflation data: Friday, 6:00. The bump up in German CPI inflation, 0.4% according to to he first release for July, contributed to a robust figure for the euro-zone. This rise in prices will likely be confirmed now. The Wholesale Price Index (WPI), is expected to rise by 0.3% in July after remaining flat in June.

- French CPI (final): Friday, 6:45. Prices in France also advanced nicely in July according to the preliminary read, 0.3%. And also here, the number will likely be confirmed.

- French Non-Farm Payrolls: Friday, 6:45. The French economy is also seeing a rise in jobs, 0.3% was reported in Q1. A similar rise is on the cards in the preliminary read for Q2 2017. Another rise of 0.4% is estimated.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar saw no real limits on its way up, reaching levels seen back in early 2017.

Technical lines from top to bottom:

We start from higher ground this time. 1.2565 capped the pair back in late 2014. It is followed by 1.2240, another line from that time and 1.2170, quite close by.

1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010, also seen in early August 2017.

1.1712 was the swing high in August 2015, the highest point after the ECB announced QE. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I am bulish on EUR/USD

The trend remains to the upside, with everything working in favor of the euro. The pair did take its time to consolidate and without any risk to its rise, economic, monetary and political advantages are set to push the pair higher once again.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!