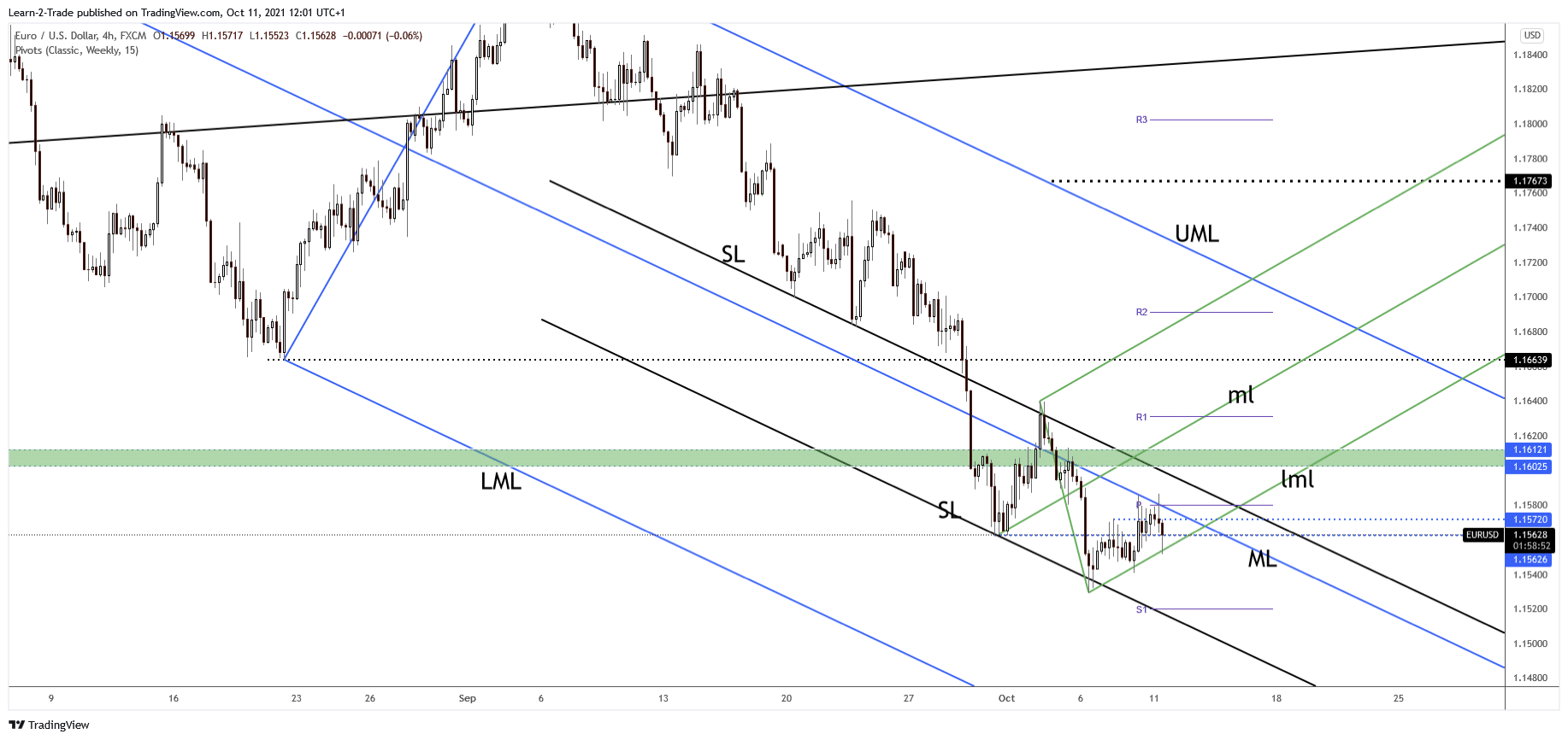

- EUR/USD searches for direction below the descending pitchfork’s median line, a new lower low could activate more declines.

- The US inflation data and the FOMC Meeting Minutes could be decisive on Wednesday.

- The bias remains bearish as long as it stays under the median line (ML).

Our EUR/USD forecast bites that the pair dropped in the last few hours and erased today’s gains. It’s located at 1.1565 level, far below 1.1586 today’s high. The price action printed a potential continuation pattern, a minor up channel.

Still, we’ll have to wait for confirmation before taking action on this pair.

3 Free Forex Every Week – Full Technical Analysis

The bias remains bearish despite a temporary rebound and even if the US NFP disappointed on Friday. The price could extend its sell-off if the Dollar Index resumes its upwards movement.

The US Dollar was expected to appreciate after the US ISM Services PMI, ADP Non-Farm Employment Change, and the Unemployment Claims came in better than expected.

Non-farm payrolls disappoint, FOMC will be pivotal

Unfortunately for the USD, the Non-Farm Employment Change reported only 194K jobs in September versus 490K expected and compared to 366K jobs in August.

Tomorrow, the Eurozone ZEW Economic Sentiment and the German ZEW Economic Sentiment could bring life to the EUR/USD. Still, maybe the traders will wait for the US inflation data to be released on Wednesday before pushing the price in one direction.

Also, the FOMC Meeting Minutes is seen as a high-impact event, so most likely we’ll have a clear direction soon.

EUR/USD Forecast: Price Technical Analysis – False Breakout

The EUR/USD continues to stay right below the descending pitchfork’s median line (ML) after failing to take out the dynamic support represented by the ascending pitchfork’s lower median line (lml).

The pressure remains high after registering a new false breakout through the median line (ML). Also, it has registered a false breakout with great separation above 1.1580 weekly pivot point. Personally, I’ve drawn an ascending pitchfork on the H4 chart. The EUR/USD pair may signal a deeper drop if it makes a valid breakdown below the lower median line (lml).

From the technical point of view, a broader rebound, upwards movement will be activated if the pair jumps and stabilizes above the median line (ML), weekly pivot point (1.1580), and above the upside sliding line (SL).

Actually, a new higher high, a bullish closure above 1.1586 today’s high may signal further growth in the short term, while a new lower low, a bearish closure below 1.1552 could activate more declines.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.