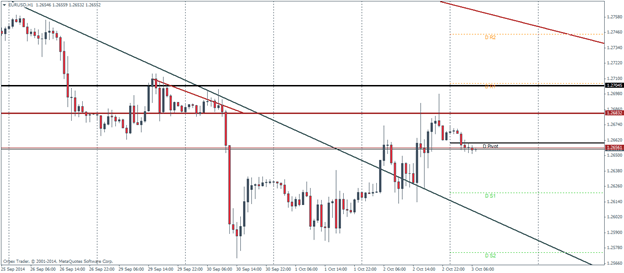

EURUSD Daily Pivots

| R3 | 1.2744 |

| R2 | 1.267 |

| R1 | 1.2705 |

| Pivot | 1.2659 |

| S1 | 1.2621 |

| S2 | 1.2574 |

| S3 | 1.2536 |

Boosted by Draghi’s inaction, EURUSD rallied only to be capped at 1.26832 as noted in yesterday’s analysis. With today’s all important NFP numbers due, EURUSD is at a pivotal point of moving either way. A drop lower could see a test of the trend line for a rally back towards 1.26832, while a break of this resistance level could give way for more upside gains towards 1.2745. From the daily time frame, yesterday marked the third consecutive day of a higher lower bring made, after an inside bar was printed the day before, which puts the bias towards an upside price action today.

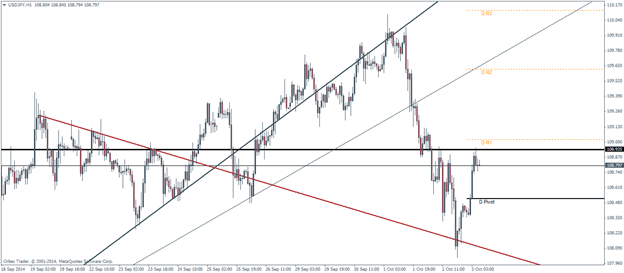

USDJPY Daily Pivots

| R3 | 110.128 |

| R2 | 190.624 |

| R1 | 109.02 |

| Pivot | 108.516 |

| S1 | 107.912 |

| S2 | 107.408 |

| S3 | 106.804 |

USDJPY hit the resistance of 108.935 earlier today after bouncing off the trend line yesterday. A test of this previously known support/resistance level, if it holds could see a drop to the next support level which marks today’s pivot price of 108.5. Current price action on the H1 charts near the resistance level of 108.935 shows a bearish candlestick followed by a doji.

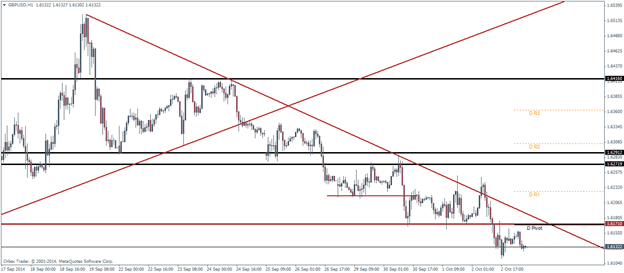

GBPUSD Daily Pivots

| R3 | 1.6363 |

| R2 | 1.6306 |

| R1 | 1.6225 |

| Pivot | 1.6169 |

| S1 | 1.6088 |

| S2 | 1.6031 |

| S3 | 1.595 |

As the Cable broke the support of 1.6171, a successful retest for resistance could see more declines on the horizon with a lower target to 1.607, which forms a major support level from higher time frames. A break lower could put to question any possible motives of a bull run resuming and could point to further downside targets. The likely catalyst for breaking the resistances could be only if the NFP was weaker than expected today, which could breathe some life back into GBPUSD.