The Swiss National Bank made a move: they set a negative deposit rate of 0.25%, even lower than the the ECB’s -0.20% deposit rate. It also changed the Libor Rate to a range of -0.75% to +0.25%. This was an emergency meeting by the SNB.

The move also has implications on EUR/USD.

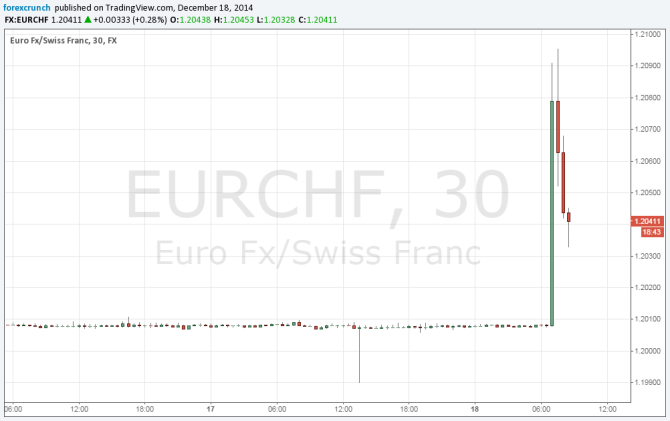

While the timing of the move is somewhat surprising, there was a lot of pressure on EUR/CHF, that was stuck very close to the SNB’s 1.20 floor. This moves sent EUR/CHF away from the floor, all the way to 1.2090 before it slid back down. Switzerland still enjoys a very low unemployment rate and just announced a wider than expected surplus of 3.87 billion.

Here is the EUR/CHF chart, which clearly shows the shock:

The collateral effect on EUR/USD was also quite interesting: the pair dipped to lower ground and hit support at 1.2280 bouncing back up.

The euro is still hit by the hawkish words from Janet Yellen we heard last night and it is awaiting the German IFO Business Climate number, that could lift it.

Here is the move on the EUR/USD chart: