EUR/USD wobbled quite a bit on the disappointing NFP and now it faces a critical event in the euro-zone: the ECB meeting. Here are two opinions:

Here is their view, courtesy of eFXnews:

EUR/USD Post NFP & Ahead Of ECB – Barclays

EURUSD downside momentum waned last week following weaker-than-expected US manufacturing ISM and mixed labour market data.

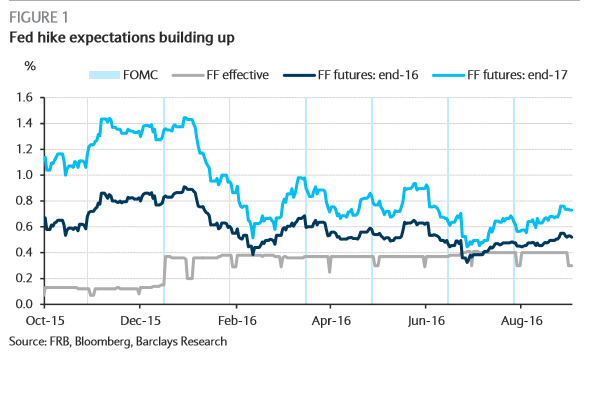

The payroll report last week showed a lower-than-expected job creation, at 151k. Despite the slower pace of job gains, the report indicates that labor market health remains intact and, therefore, that economic activity remains solid. As such, we viewed the US labour market report as “just enough” to confirm the recent trend and continue to forecast a September rate hike against market expectations for an unchanged policy decision.

In that regard, reactions of Fed officials will be watched this week. On Tuesday, San Francisco Fed President Williams will speak on the economic outlook. He should give a solid signal of whether the headline number was strong enough, in his view, to warrant a rate hike. On Friday, Boston Fed President Rosengren will speak. We believe he supports one rate hike this year and is likely agnostic over the precise timing of the hike around that framework.

This week’s ECB policy meeting (Thursday) will likely be neutral for EURUSD, in our view. Without significant changes to EA activity since June, we expect the ECB to adopt a ‘wait and see’ response, keeping all policy settings unchanged

Our own expectation for European growth is that the political and policy risks, which were already elevated for Europe, have become even more pronounced post-Brexit. We think these risk factors will eventually lead to investment weakening by the end of 2016 but do not think the ECB will factor in these political risks at this juncture. We also expect only marginal downward revisions to the ECB’s inflation projections with risks still skewed to the downside. Our expectation for further policy easing in H2 16 remains in place, however, with the ECB likely expanding its QE by six to nine months at its October or December meetings, accompanied by modifications to the programme’s technical parameters. We think that this move is highly expected by the FX markets.

The week is relatively quiet in terms of US data releases. We expect the ISM non-manufacturing to move down to 55.4 in August (Tuesday). We believe the slightly higher readings over the past two months reflect, in part, a bounce back after soft activity in the first five months of the year. At this level, non-manufacturing activity will continue to expand.

On the EUR data front, we expect German factory orders growth (Tuesday) to come in at 0.5% m/m, rebounding somewhat from the 0.4 point decline in June as PMI new orders still stand well above the 50-threshold indicating expansion. We look for the final reading of euro area Q2 GDP to be confirmed at 0.3 q/q% (Tuesday), forecast German industrial production growth (Wednesday) to contract 0.2% m/m, less than offsetting June’s 0.8% m/m growth and look for French industrial production (Friday) to rise by 0.4% m/m in July after two consecutive negative months.

3 Possible Changes To ECB’s Purchase Rules Of Government Bonds – BNPP

We expect the ECB to announce an extension of its QE program beyond its March 2017 expiration at this week’s meeting. In order to address concerns about scarcity of paper, we also expect changes to the rules governing the purchase of government bonds. Our rates team sees three possible changes 1) increasing the issue share limit; 2) removing deposit rate floor; 3) moving away from capital key based allocation of purchases. Our rates strategy team see risks that long-end core yields rise in the aftermath of the decision, even if the ECB does deliver.

However, with front-end rates likely to be anchored we would not anticipate meaningful benefit for the EUR. In any event, we look for the evolution of US rates to dominate EURUSD this week.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.