The euro managed to stabilize, in part thanks to a correction in the dollar. At 1.06, what is the next move for the pair?

The team at Bank of America Merrill Lynch see parity as the next move:

Here is their view, courtesy of eFXnews:

Bank of America Merrill Lynch cuts today its EUR/USD forecasts stating that while they have been a consistent bearish EUR, it now turns out that they have not been bearish enough.

Finally, a weak Euro

“We have been bearish EUR. Our thesis has been that the divergence of ECB and Fed monetary policies will weaken the Euro from an overvalued level. Up to mid- 2014, we were getting a strong pushback from investors about our bearish Euro view, but it now turns out that we have not been bearish enough,” BofA clarifies.

And the Euro could weaken further.

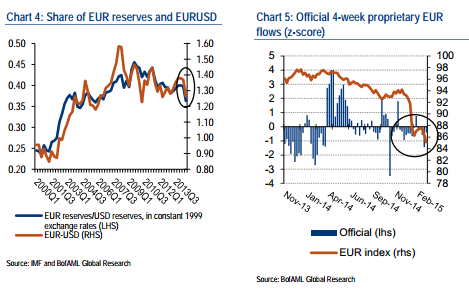

“Correlations with data and fundamentals suggest that EUR/USD may have overshot. However, the market is not trading as if it is short Euro. Indeed, our most important take-away from the further weakening of the euro this week is the magnitude of the decline relative to any new information. Central bank reserve managers are also contributing to the Euro’s weakness,” BofA adds.

New forecasts: EUR/USD at parity by end-2015.

“We are revising our EUR/USD projections, expecting parity by the end of 2015. For now, we expect it to stay at parity in 2016, although a lot will depend on whether the ECB will introduce QE2 after September 2016, or not. If Eurozone data improves and QE is not needed after September, this will be bullish for the Euro. However, if the data is weak and the ECB needs QE for one more year, this will be bearish for the Euro. At this point, it is too early to tell,” BofA projects.

“Our forecast changes are consistent with our expectation that the ECB’s bond purchases will generate EUR negative flows, but remain cautious. We expect that a high share of bonds that the ECB will be buying will come from holdings by foreign investors and have estimated that this could lead to as much as €10bn worth of EUR selling against other currencies every month. However, we remain cautiously bullish the USD in the short term, as further appreciation would fuels recoupling concerns,” BofA adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.