EUR/USD is at crossroads: despite the slide, it is hesitating and lacking conviction. What’s next? The team at Nordea checks out both options:

A special segment ahead of the big Brexit vote:

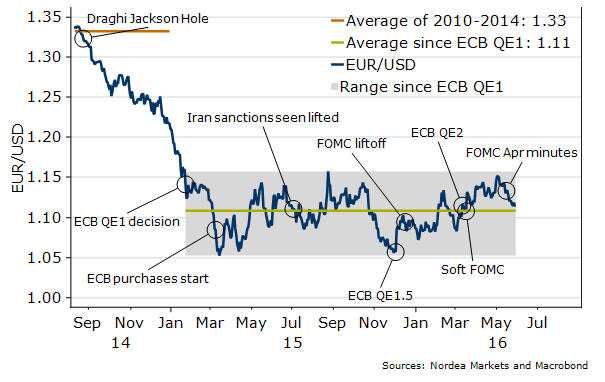

The Fed’s fears has gradually receded, prompting a surge in likelihood for a summer hike which has put the USD back on track (+3% in May). A summer rate hike as well as markets glacial pricing of the Fed’s hiking cycle offer support for the USD, while we see no change in stance from ECB. Instead, ECB’s corporate QE and UK’s Purdah rules pose some downside risks to the pair in coming months.

The USD has reasserted itself strongly over the course of May, with the trade-weighted greenback set to see its strongest (3%) gain since the first month of 2015. The Fed’s fears, as we catalogued a month ago, has gradually receded, prompting a surge in likelihood for a summer rate hike.

While a Fed summer hike offers the USD some support from the policy divergence perspective, its December liftoff offered unknowns such as the “undiscountability” of the Death Star which its next hike does not – hence some tempering of optimism should be warranted.

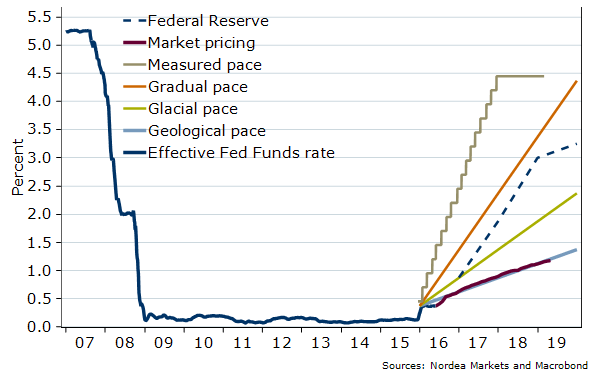

Chart 1: The Fed vs the market

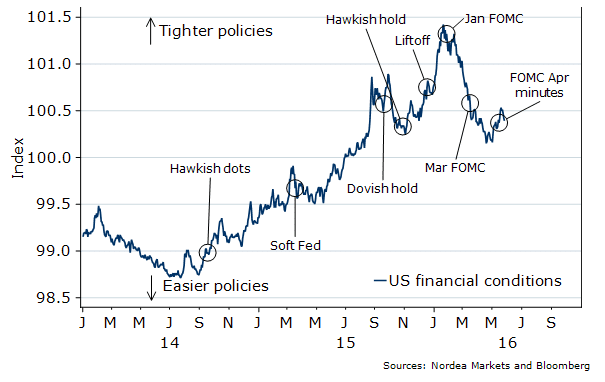

Even so, the market is pricing-in a rate hiking pace of merely one hike per year. This is not gradual, nor glacial (chart 1). It’s a geological rate hiking pace, and a far cry from what was often taken to mean gradual in 2015 (four hikes per year(*)). As long as economic data delivers and financial conditions does not tighten too rapidly (chart 2), this depressed pricing by itself offers support for the USD.

Chart 2: Financial conditions still very easy

On the other side of the Atlantic, we see no near-term change to the ECB’s policies even though it may be motivated to hike its growth and inflation forecasts somewhat. We continue to view any talk of tapering as highly premature.

There are other factors potentially supportive of the USD (vs EUR) in coming months: i) ECB:s commencement of corporate bond purchases, which could attract EUR issuance, depress basis swaps and weigh on the common currency, ii) the UK’s Brexit vote – remain sentiment could potentially face setbacks. UK’s Purdah rules will prevent civil servants and public officials from making announcements ahead of the referendum on June 23. Communications momentum could start to favour the “leave” camp, which resides outside of the government (while mostly GBP-negative, we also think a Brexit would be negative for EUR/USD).

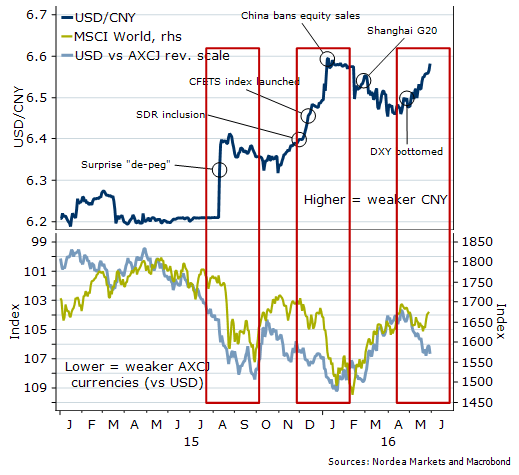

Chart 3: Will PBoC care about the USD and will market care about CNY?

Finally, China’s reaction to recent USD gains bears watching as a higher USD/CNY has been at the centre of the last three major risk-off episodes (chart 3). If PBoC lets USD/CNY rise on the back of USD weakness it could pose risks to risk sentiment which could impact upon the Fed and consequently on the USD.

Chart 4: EUR/USD – at its post ECB QE1 average

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.