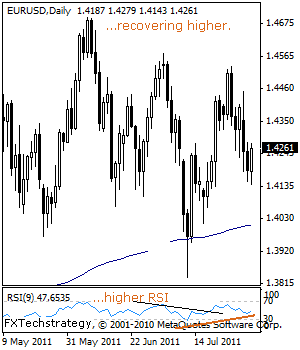

EURUSD: Halts Declines, Strengthens

EURUSD: The pair may have triggered a recovery higher but still retains its bear threats started from the 1.4534 level.To prevent a return below the 1.4143 level, EUR will have to break and hold above the 1.4534/76 levels.

This will pave the way for a run at the 1.4696 level, its Jun 07’2011 high. Further out, the 1.4938 level, its 2011 high comes in as the next upside target.

Guest post by www.fxtechstrategy.com

On the other hand, below the 1.4143 level will set the stage for further weakness towards the 1.4014 level, its July 18’2011 low.

Further risk to our analysis will be a continued decline and a return to the 1.3837 level where a firm break will resume its short term weakness towards its Mar 06’2011 low at 1.3751. Further support lies at the 1.3700 level, its psycho level.

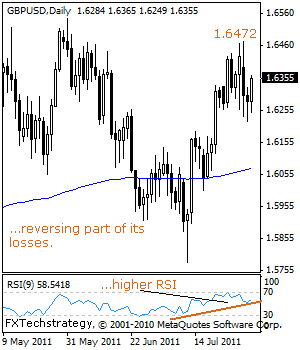

GBPUSD: Rallies, Maintains Consolidation Tone

GBPUSD: The pair has halted its declines started from the 1.6472 level and is now seen strengthening.

This suggests that on continued upside gains, it will target the 1.6472 level where a decisive break will open the door for further strength towards the 1.6546 level, its May 31’2011 high.

A cut through here will open the door for more upside gains towards the 1.6743 level, its 2011 high. Its daily RSI has turned higher supporting this view.

On the downside, support comes in at the 1.6222 level traded on Tuesday with a violation of that level eyeing the 1.6193 level where a cap is likely to occur.

However, the bigger challenge will be a break and hold below the 1.5778 level, its July 12’2011 low. In such a case, the 1.5749 level, its Jan 25’2011 low will be targeted followed by the 1.5700 level, its psycho level.