Banks remain bearish on EUR/USD and the arguments are both technical and fundamental. The notable exception is Credit Agricole.

The Team at Credit Suisse join the bearish bandwagon, and use Fibos to explain the next low target for EUR/USD:

Here is their view, courtesy of eFXnews:

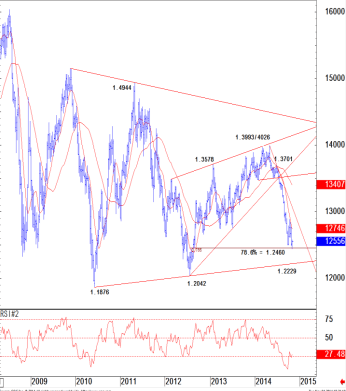

EUR/USD keeps holding above key support at 1.2460 – the 78.6% retracement of the 2012/2014 uptrend, notes Credit Suisse.

“We allow for this run further, but we stay bearish and look for an eventual clear move beneath 1.2460 and then 1.2441 recent low to test 1.2387/83 next,” CS projects.

A break of the latter in due course, according to CS, can then expose potential medium-term trend support at 1.2220, before better buying ideally start to show here.

“Resistance moves to 1.2592 initially, above which can ease the immediate downside bias for a recovery back to 1.2604/31 – the 38.2% retracement of the decline from 1.2888 – with 1.2771 ideally capping any further recovery,” CS adds.

In line with this view, CS maintains a short EUR/USD with a stop at 1.2645, and a target at 1.2230.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.