The Euro traded a touch lower during the Asian session against the US dollar, but later the EURUSD pair managed to jump higher again from the 1.3680 support level. There were few important releases in the Euro zone, including the German manufacturing PMI, Spanish manufacturing PMI, French manufacturing PMI, Italian manufacturing PMI and German unemployment data.

The outcome of all these events was mostly on the mixed side and both German unemployment change and the Euro zone manufacturing PMI missed the forecast. However, the readings were not at all on the negative side, and considering that the Euro was seen trading higher post the releases.

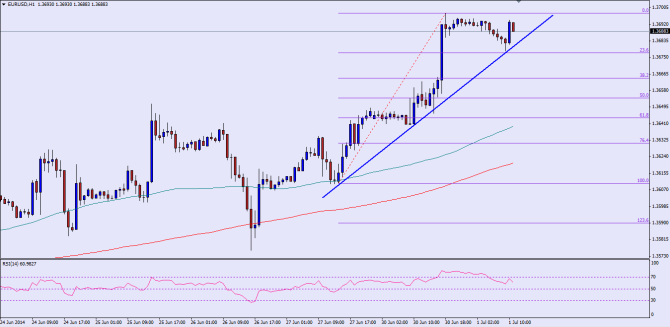

Technically, the EURUSD pair bounced from a significant support confluence zone. There is an important trend line on the hourly timeframe, which is also coinciding with the 23.6% fib retracement level of the last run from the 1.3610 low to 1.3696 high. So, this particular bounce can be considered as important, and it would be interesting to see whether the pair can manage to clear yesterday’s high or not. A break and close above the 1.37 level might call for more gains in the pair in the short term.

Alternatively, if the EURUSD pair falls from the current levels, and fails to hold the trend line and support area, then the pair can fall towards the 38.2% fib level, followed by the 50% fib level. If sellers take control, then momentum could take the pair towards the 100 hourly simple moving average where buyers might reappear.

There is a divergence on the hourly RSI, which can be considered as a warning sign. So, it would be better not to chase any further strength in the EURUSD pair.

Posted By Simon Ji of IKOFX