Euro dollar continues it’s near perfect channel trading and moves higher. The EU Summit failed to produce any news regarding the burning issues of Greece and weak figures from Germany and France. The Greek PSI deal is forever “close” as Portugal continues signs of following the Hellenic Republic. End-of-month moves also make the market more choppy. Will the pair fall when the month ends?

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: The pair continue rising in the Asian session and into the European one, tackling 1.3212.

- Current range: 1.3145 to 1.3212.

- Further levels in both directions: Below 1.3145, 1.3060, 1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623

- Above: 1.3212, 1.3280, 1.3333, 1.3450 and 1.3550.

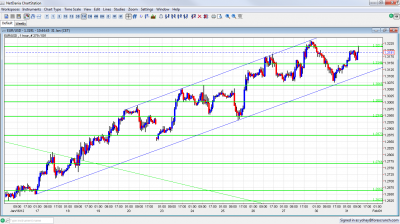

- Note the uptrend channel on the hourly chart. The pair is now in the middle of the range, after failing to break higher.

- 1.3060 is a clear line that separates ranges.

- 1.3212 is strong on the upside and currently capped the pair.

Euro/Dollar in channel- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Retail Sales. Exp. +0.9%. Actual -1.4%. Bitter disappointment.

- 7:45 French Consumer Spending. Exp. +0.3%. Actual -0.7%.

- 8:55 German Unemployment Change. Exp. -8K. Actual -34K. Good news for a change.

- 10:00 Euro-zone Unemployment Rate. Exp. 10.4%. Actual: 10.4%.

- 13:30 US Employment Cost Index. Exp. +0.4%.

- 14:00 US S&P/CS Composite-20 HPI. Exp. -3.3%. Important for QE3.

- 14:45 US Chicago PMI. Exp. 63.1 points.

- 15:00 US CB Consumer Confidence. Exp. 68.2 points. See how to trade this event with USD/JPY.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- EU Summit Doesn’t Address Greece?: The leaders of Europe discussed the fiscal compact, with another country falling out: the Czech Republic. The question of a referendum in Ireland is still open. Greece was discussed in the sidelines of the summit, with another statement about closing the PSI deal “by the end of the week”. It always seems close, yet elusive. The sides are reportedly discussing only technical details.. It’s important to note that German Chancellor Angela Merkel has doubts if Greece can avoid a default.

- Portugal deteriorates: Portuguese yields continue rising together with CDS, and point to a high chance of default. The chances of a default there are rising, especially if a PSI deal is signed in Greece and especially if also the ECB takes a hit.

- ECB Pressured to take a haircut: More and more speakers call for the ECB to take a hit on Greek bonds, despite the “no bailout” clause in the EU Treaty. The pressure comes from the banks (naturally) and also from the IMF. Note that ECB president Draghi didn’t categorically reject this.

- US Economy still growing, but slowly: The first estimate for Q4 disappointed with a lower-than-expected headline figure, 2.8% and weak underlying components. This fuels expectations for QE3.

- Italy still lags behind Spain: Italy was lagging behind Spain in bond auction and yields. Spain raised more money than expected while Italy continued paying high prices. Italy is now catching up, but still remains behind. The LTRO of the ECB certainly plays a big role. In the meantime, Spain reported economic contraction in Q4 2012.

- Fed Extends Zero Rate Policy: The FOMC Statement contained one significant change: the low rates are now likely to remain until late 2014, instead of mid 2013 stated earlier. Together with a hint by Bernanke that QE3 is still open, the dollar fell and the pressure on the greenback will remain in weeks to come.