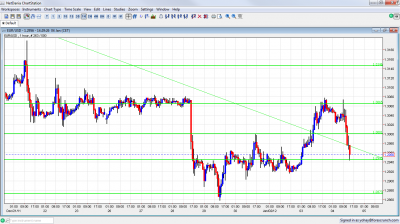

Euro dollar made a big move downwards, losing the New Year optimism and refocusing on new worries from Spain and Italy. Recession seems more and more real. The pair reached the pivotal line. Will it stop here? The move higher seems indeed like short covering. The first sign for the US Non-Farm Payrolls was very positive.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: Quiet session saw consolidation of gains at high ground. The European session already saw a significant drop.

- Current range: 1.2945 – 1.300

- Further levels in both directions: Below 1.2945, 1.2873 , 1.2720, 1.2650 and 1.2580.

- Above: 1.30, .13060, 1.3145, 1.3212, 1.3280, 1.3380

- 1.2945 returns to work as support, after the move to 1.3060 and back.

- The break under 1.2873 proved fake. The new 2011 low of 1.2858 was just a swing.

Euro/Dollar losing New Year gains- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:45 French Consumer Spending. Exp. +0.3%. Actual -0.1%.

- 9:00 Euro-zone Final Services PMI. Exp. 48.3. Actual 48.8.

- 10:00 Euro-zone CPI Flash Estimate. Exp. +2.8%. Actual 2.8%.

- 15:00 US Factory Orders. Exp. +1.9%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Spain might need help for banks: After acknowledging that the deficit for 2011 is closer to 8% than 6%, there are reports that the new government might ask for help from the IMF or the EU to help its banks. Spanish banks are thought to overvalue real estate property values.

- Italy doesn’t want help: The technocrat PM Mario Monti said that approaching the IMF would be bad for the euro-zone’s third largest country. The echoes from a bad bond auction in which Italy paid high prices once again are still heard. 10 year yields are under 7%.

- Germany’s low yield: Germany raised money in 10 year bonds and paid a very cheap price. On the other hand, it didn’t reach the maximum amount, but it was better than a similar failed auction at the end of 2011.

- Merkozy summit: The leaders of Germany and France plan to meet on January 9th and take new steps to fight the debt crisis. A wider summit is planned for January 30th. Merkel and Sarkozy have new steps in mind.

- Gloomy expectations for 2012: On the other hand, most media outlets posted grim outlooks for 2012 concerning the euro-zone as austerity measures push the economies into recession, this in turn triggers more austerity and the vicious circle continues.

- Iran tests missiles: Iran proceeded with testing missiles in the Persian Gulf. The threat of closing the Straights of Hormuz supports oil prices and this weighs on the US dollar. Note that Mid-East violence could erupt in Syria, Lebanon and Israel rather than the Persian Gulf.

- US Manufacturing provides optimism for NFP: The ISM figure not only exceeded expectations but boasted strong growth in employment. This provides hope for a strong Non-Farm Payrolls result on Friday, although the services sector is more important.