EUR/USD is subdued in Thursday trading, as the pair continues to trade close to the 1.32 line in the European session. On Wednesday, there were positive PMI releases out of the Eurozone, but the euro failed to take advantage and edged lower. US New Home Sales sparkled, jumping to a five-year high. Taking a look at Thursday’s events, German Ifo Business Climate inched higher and practically matched the forecast. Spanish Unemployment was a surprise, beating the forecast. We could see some activity from EUR/USD later in the day, with two key events due out of the US – Core Durable Goods Orders and Unemployment Claims.

Here is a quick update on the technical situation, indicators, and market sentiment that moves euro/dollar.

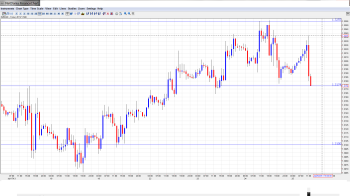

EUR/USD Technical

- Asian session: Euro/dollar moved above the 1.32 line and touched a high of 1.3209 late in the session. The pair consolidated at 1.3209. In the European session, the pair has retracted, dropping below 1.32.

Current range: 1.3175 to 1.3255.

Further levels in both directions:

- Below: 1.3175, 1.31, 1.3050, 1.30, 1.2940, 1.2890 and 1.2840.

- Above: 1.3255, 1.3350 and 1.34.

- On the downside, the pair is testing 1.3175. The round number of 1.31 continues to provide significant support.

- 1.3255 is providing resistance. 1.335o is stronger.

EUR/USD Fundamentals

- 7:00 Spanish Employment Rate, exp. 27.2%, actual 26.3%.

- 8:00 German Ifo Business Climate, exp. 106.3, actual 106.2 points.

- 8:00 Eurozone M3 Money Supply, exp. 3.0%, actual 2.3%.

- 8:00 Eurozone Private Loans, exp. -0.9% actual -1.6%.

- 12:30 US Core Durable Goods Orders, exp. 0.5%.

- 12:30 US Unemployment Claims, exp. 339K.

- 12:30 US Durable Goods Orders, exp. 1.1%.

- 12:45 US Treasury Secretary Jack Lew Speaks.

- 13:00 Belgium NBB Business Climate, exp. -11.2 points.

- 14:30 US Natural Gas Storage, exp. 44B.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- New Home Sales soar: The week started off an a disappointing note as existing home sales disappointed with a drop to 5.08 million, and this pushed the dollar lower across the board. However, New Home Sales more than made up for this weak release, jumping from 476 thousand to 496 thousand, well above the estimate of 482 thousand. This was the key housing indicator’s best performance in five years. With mixed housing releases this week, we’ll have to wait for further data to get a better handle on the direction of the US housing sector.

- Eurozone posts positive PMIs: There was good news out of the Eurozone on Tuesday, as European PMIs looked strong. Eurozone, German and French Services and Manufacturing PMIs all beat their estimates, pointing to improvement in the services and manufacturing sectors. The markets were especially pleased with the German data, as both PMIs came in above the 50 level, which is the separator between expansion and contraction. Despite showing improvement, both French PMIs still remain below 50, which has been the case throughout 2013. Eurozone PMIs were a mix, with the Manufacturing PMI climbing to 50.1 points, while Services PMI moves closer to expansion, rising to 49.6 points. If additional services and manufacturing indicators out of the Eurozone follow pace and point upwards, the euro could continue to post gains against the dollar.

- Will Fed taper QE in September?: QE tapering remains a hot topic, and it is looking increasingly likely that the Fed will take some action before the end of the year. A new survey of economists show that half of them see tapering in September, from a scale of $85 to $65 billion. This is a rise compared to previous surveys. Is a QE downsize already priced in by the markets? There is a Fed decision at the end of July, but expectations are low that we will see any changes to QE. Fed chair Bernard Bernanke testified before Congress and did not really add anything new. Bernanke said that monetary policy would remain accommodative, and that the pace of bond buys is “not on a preset course“. This rather vague statement leaves the Fed plenty of wiggle room to scale down QE when it chooses to do so. Bernanke reiterated that any decision to taper QE would depend on economic conditions. He noted that present unemployment levels (7.6%) were “well above” normal levels, and shied away from presenting any time deadlines for scaling down QE. So the markets were left with the message that any tapering will be delayed until the recovery deepens and unemployment falls. Job figures remain left, right and center for markets.

- Spanish unemployment rate drops: An unemployment rate of over 26% is not news to celebrate, but it was a ray of good news for Spain, which saw its staggering unemployment rate drop from 27.2% to 26.3%. This marked the first monthly drop since July 2011, when the unemployment rate was around 21%. We have seen some positive data out of Spain recently, leading Spain’s finance minister de Guindos to declare that Spain’s economy is improving “beyond seasonal effects”. The markets are hoping that the finance minister is right and that economic releases continue to point upwards after the summer.

- German optimism buoyed by strong data: The German Bundesbank assessed that the euro-zone’s locomotive enjoyed strong growth in Q2, but is set to slow down in Q3. This week’s strong numbers have been a breath of fresh air. On Tuesday, Manufacturing PMI jumped from 48.7 to 50.3 points, and Services PMI kept pace, improving from 51.3 to 52.5 points. Both indexes were well above their estimates. There was more good news on Wednesday, as the all-important Ifo Business Confidence improved slightly and met market expectations. Germany is facing elections on September 22nd, and the economy promises to be an important issue in the election campaign.

- Recent technical analysis articles: EUR/USD set to extend gains