The hot summer month of July provides interesting seasonal patterns on EUR/USD.

The team at Nordea explains with plenty of chart:

Here is their view, courtesy of eFXnews:

The strong – and non-intuitive – correlation of EUR/USD may be explained with ETF flows, and could persist for quite a while. While seasonality is mildly supportive of the EUR in July, waning Euro equity performance as well as the ECB/Fed outlook suggest a stronger USD after the summer.

-EUR/USD’s correlation with equities will remain nonsensical

-Seasonality of portfolio flows normally mildly EUR-supportive in the near term

-Waning Euro equities and the Fed suggest a stronger USD after the summer

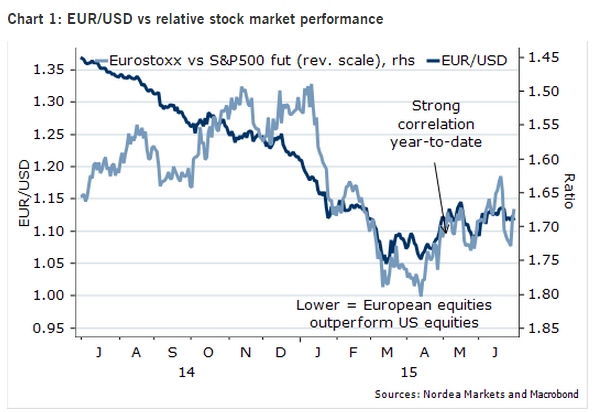

EUR/USD has mostly traded sideways over the past two months, albeit with significant intra-day volatility. Intra-day volatility has been the highest since the middle of 2011, when the European debt crisis was a thing. After gapping lower as markets started to trade after the most recent batch of worrisome news out of Greece, the pair staged a healthy rebound. Many market participants were indeed quite surprised by the strong come-back of the EUR. Interestingly, the pair is showing a surprisingly strong, and non-intuitive, correlation with European equity markets.

As markets turned pessimistic on the potential for a Greece deal, what would have been intuitive – a move lower of the EUR on somewhat lower risk premiums – seems to have been overshadowed by FX hedging activity due to a (also reasonable) move lower in Eurostoxx. Hence the EUR has tended to depreciate when it looks as if the Greece situation is being solved, while tending to strengthen on Grexit worries(!). This is absurd, but may reflect flows from rebalancing of FX hedges, especially given the “new normal” of illiquid markets.

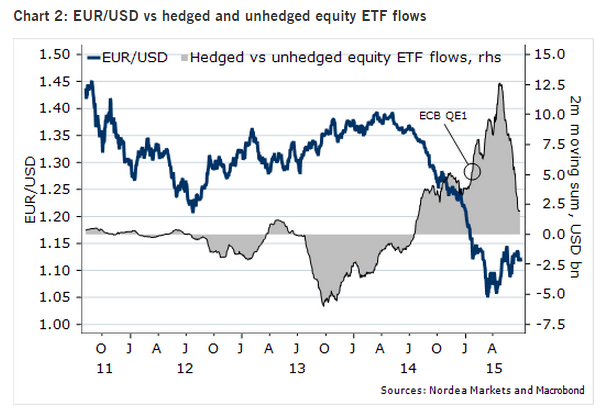

To begin with, the economic & central policy divergence theme between the US and the Euro Area last year prompted purchasers of EUR equities to increasingly hedge their FX exposure. Not doing so would have prompted the stronger USD to diminish local-currency returns. This behavior accelerated as investors prepared for ECB QE1, which was launched in January this year. Not only did investors pile in en masse in EUR equities, they increasingly did so while hedging their FX exposure.

If this conjecture is what is playing out, we should expect the EUR/USD to remain negatively correlated with stock markets until these ETF flows reverse in a more significant way. That said, as the statistically inclined are wont to point out, this will not necessarily determine the trends in the FX space – especially if the divergence/dollar theme roars back to life later this year.

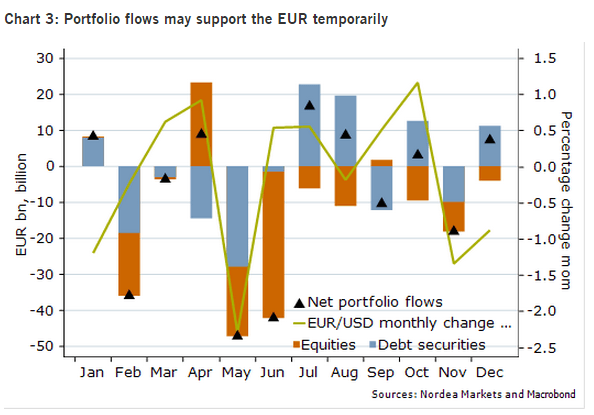

In the near term, the seasonality for the EUR/USD is mildly supportive. We are not very big fans of seasonal analysis of FX, but given how large and EUR-negative the portfolio flows have been over the past few quarters, it is worth pointing out. The EUR/USD normally gains a touch in July (0.5% on average, highly marginal vs the new normal intra-day range of some 2 big figures). Portfolio flows do tend to be supportive of the single currency however, with debt inflows of more than EUR20bn on average.

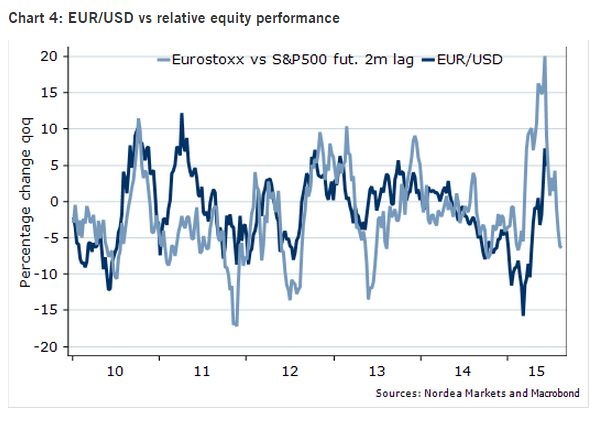

Looking beyond mildly supportive near-term seasonality, it appears as if equity markets’ performance has been leading the way for EUR/USD, with stock markets leading spot FX developments by two months. This may have helped pressure EUR/USD higher recently. However, this upside pressure is abating. The lead/lag relationship actually implies a EUR/USD between 1.05 and 1.10 by mid-August (a 5% lower EUR/USD than in mid-May”¦), well ahead of the FOMC rate decision September 17.

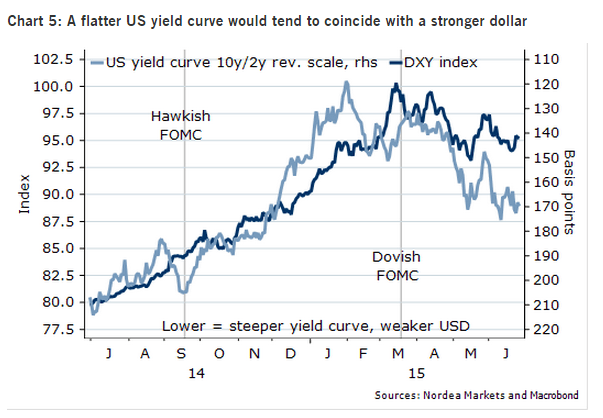

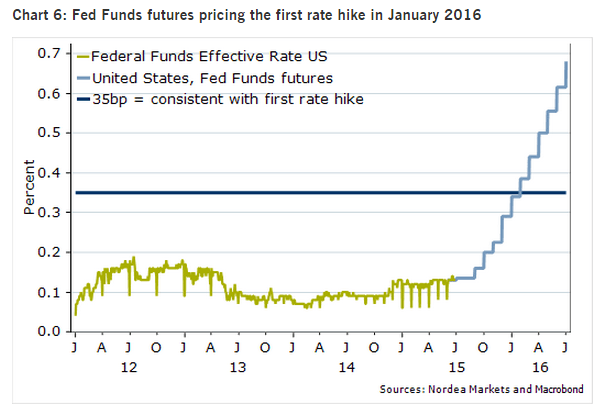

Fed Chair Yellen will attend a semi-annual congressional hearing on July 15, where her take on the US economy and on monetary policy will be closely scrutinized with regards the timing of the first Fed rate hike. Her heavy-hitting colleague, NY Fed’s Dudley, said a few days ago that “data has made him less worried”, and that 2.5% growth could make him back a rate hike already in September. The market is currently pricing-in the first Fed rate hike in January of 2016, long after our forecast of a September rate increase. If we are right on September, then markets will need to reassess the front end of US rates, which should lead to a flattening of the US yield curve which normally tends to coincide with broad USD strength.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.