EURUSD buyers were unfazed by the preliminary inflation report for the Euro zone released yesterday. The report suggested that Euro area annual inflation is expected to be 0.5% in March 2014, down from 0.7% in February.

The outcome was on the negative side, as it might weigh on the ECB to act in the coming meetings. EURUSD spiked lower towards 1.3710, and then traded back above 1.3780 level.

German Unemployment report

About an hour ago, German unemployment data was published by the German Statistics Office. The outcome was surprising, as roughly 41.7 million persons resident in Germany were in employment in February 2014, and German unemployment rate now stands at 6.7%, beating the expectations of 6.8%. The previous reading was also revised lower from 6.8% to 6.7%. Overall, data was impressive, and as a result EURUSD jumped higher to overtake the 1.3780 level again.

Technical Analysis

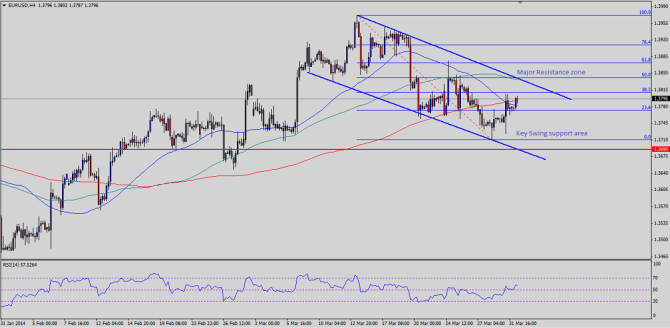

EURUSD is approaching 38.2% Fibonacci retracement level of the last leg lower from 1.3972 high to recent 1.3710 low. The pair has breached the 50 and 200 simple moving average on the 4 hour timeframe. There is a channel forming, which can act as a catalyst for the pair in the coming days. On the upside, 1.3840 level might act as a hurdle for the pair. It represents triple confluence zone of 50% Fibonacci retracement level, channel resistance zone and 100 SMA. A break above this resistance zone might open the doors for a test of 61.8% Fib level.

On the downside, 50 simple moving average is seen as immediate support, followed by 1.3750, where buyers have appeared time and again. Any further bearish momentum might take the pair towards the channel trend line and previous swing support zone at around 1.3700 level.