EUR/USD begins the new week and the last day of the quarter and the first half of 2014 by flirting with resistance at 1.3650. The definitive top of the range is challenged, but the pair hesitates. Towards the ECB meeting later in the week, inflation numbers are closely eyed and they carry better expectations. The US also releases interesting figures. Will we finally see a real breakout?

Here is a quick update on what’s moving the pair.

Update: CPI stands at 0.5%, core CPI rises to 0.8%

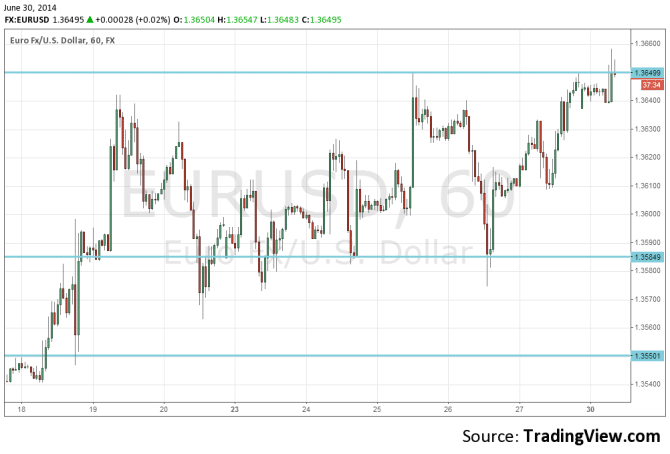

- EUR/USD traded in range before rising towards 1.3650.

- Current range: 1.3585 to 1.3650.

Further levels in both directions:

- Below: 1.3585, 1.3550, 1.35, 1.3450, and 1.34.

- Above: 1.3650, 1.3677, 1.37, 1.3740, 1.3785, 1.3830, 1.3865 and 1.3905.

- 1.3585 is an immediate support line, serving as a perfect separator of ranges.

- 1.3650 is the next line of resistance. 1.3677 is stronger.

EUR/USD Fundamentals

- 6:00 German Retail Sales. Exp. +0.8%, actual -0.6%.

- 8:00 Euro-zone M3 Money Supply. Exp. +0.7%, actual +1%.

- 8:00 Euro-zone private loans. Exp. -1.7%, actual -2%.

- 9:00 Euro-zone Flash CPI. Exp. +0.6%, core exp. +0.7%.

- 13:45 US Chicago PMI. Exp. 63.2 points.

- 14:00 US Pending Home Sales. Exp. +1.4%.

*All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Rise in inflation?: After German inflation numbers came out stronger than expected on Friday, we can certainly expect a tick up in euro-zone numbers. Both hit the lowest levels of 0.5% for the headline number and 0.7% for Core CPI in May. A move higher will enable the ECB a catch of fresh air, after months of pressure. A drop will put the pressure to do more.

- Double dose of action on Thursday: In a rare event (due to the 4th of July), the ECB’s press conference and the Non-Farm Payrolls are released at the same time, Thursday 12:30 GMT. Join a free webinar on Wednesday at 13:00 GMT about this climax of events.

- US economy – past vs. present: US Final GDP in Q1 was much worse than expected. The markets were braced for a decline of 1.8%, but the indicator shocked with a much sharper drop of 2.9%. This is really huge contraction that puts the growth forecast of 2% in doubt. On the other hand, more recent figures already look much better: this includes strong sales of homes, consumer confidence and also core durable goods orders..

- Not all is good in Germany: The drop in German retail sales joined the weak eurozone PMIs and the drop in German business confidence as seen in both IFO and ZEW numbers. Even if growth is still here, it is extremely sluggish.