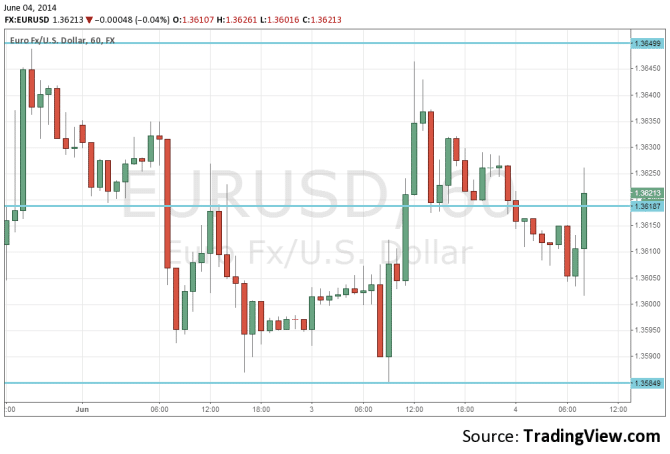

EUR/USD retreats back towards the round 1.36 line after a nice move higher in the previous sessions, staying in a tight range towards the ECB decision. After the last important piece of data is out, euro-zone CPI, speculation mounts not only about the actual decision but also regarding what is priced in and what isn’t. Will the euro fall on ECB action or actually “sell the rumor, buy the news”? We have top tier US figures today to draw the attention away from the ECB, yet only for a short while.

Here is a quick update on what’s moving the pair.

See the ECB Preview: Going negative and beyond – 6 options for Draghi

- Previous sessions: EURUSD dropped from resistance at 1.3650 during the Asian session, erasing the previous gains..

Current range: 1.3585 to 1.3650.

Further levels in both directions:

- Below: 1.3560, 1.3515 and 1.3475 and 1.34

- Above: 1.3650, 1.37, 1.3740, 1.3785, 1.3830, 1.3865, 1.3905, 1.3964 and 1.40

- On the upside, 1.3650 is the next resistance line. The round number of 1.37 follows.

- 1.3585 is immediate support after being tested once again. 1.3560 follows.

EUR/USD Fundamentals

- 7:15 Spanish Services PMI. Exp. 56.1, actual 55.7 points.

- 7:45 Italian Services PMI. Exp. 51.4, actual 51.6 points.

- 8:00 Euro-zone final services PMI. Exp. 53.5, actual 53.2 points.

- 9:00 Euro-zone PPI. Exp. -0.1%, actual -0.1%.

- 9:00 Euro-zone revised GDP, exp. +0.2%, actual +0.2%.

- 12:15 US ADP Non-Farm Payrolls. Exp. +217K.

- 12:30 US trade balance. Exp. -40.8 billion.

- 12:30 US Revised Non-Farm Productivity. Exp. -2.2%.

- 13:45 US Final Services PMI. Exp. 58.4 points.

- 14:00 US ISM Non-Manufacturing PMI. Exp. 55.6 points.

- 18:00 US Beige Book.

*All times are GMT

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- EZ inflation is at rock bottom: Eurozone CPI Flash Estimate dipped to 0.5% in May, down from 0.7% a month earlier. The estimate stood at 0.7%. Core inflation dropped to 0.5%. April’s “Easter effect” on prices was short lived. These numbers are weak and at the lowest seen so far. They add pressure on the ECB to act tomorrow.

- Draghi prepares markets: ECB president Mario Draghi denied deflation concerns again and again, but changed his mind in the ECB conference this week. Noting that deflation was a serious threat and made it clear once again after the shock comment earlier in the month, that ECB action is imminent. A cut in interest rates seems obvious and also asset purchases, liquidity injections and heavy hints about further actions are on the cards. Any one of these moves would likely have a strong impact on EUR/USD, which has retracted somewhat since testing the 1.40 level earlier in May. Is the ECB decision already priced in? Not so fast. Here is a recording of the webinar towards the event.

- Important NFP hints today: This month, the non-farm payrolls figure is released after a full buildup of top tier figures. While the ADP NFP is not fully correlated with the actual numbers, it is still a good indicator. More importantly, the employment component of the ISM non-manufacturing PMI (services sector) will also be closely watched. Hopefully ISM will not repeat the farce of the manufacturing data.

- ISM revises manufacturing data: It’s not often that a key indicator drops and magically recovers a only two hours later on. However, this was the case with ISM Manufacturing PMI. The well-respected ISM Business Survey Committee reported on Monday that the key index had softened in May, but has since corrected its reading. The index actually improved to 55.4 points in May, up from 54.9 points a month earlier. As well, Final Manufacturing PMI and ISM Manufacturing Prices improved. This points to an expanding manufacturing sector, which is good news for the recovery. We’ll get another look at manufacturing data on Tuesday with the release of Factory Orders.

See the ECB Preview: Going negative and beyond – 6 options for Draghi