Euro dollar climbed gradually and is now on the retreat once again, awaiting the decision by Ben Bernanke and his colleagues. QE3 has very low chances, but the Fed could surprise with other means. The Eurogroup endorsed Greece’s second bailout, but the final approval is due only for tomorrow. Apart from the Fed decision, there are important figures on both sides of the Atlantic.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

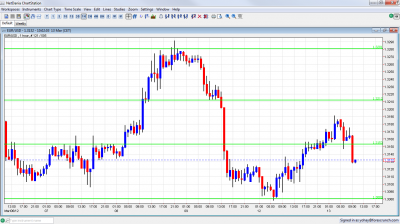

- Asian session: A slow session saw the pair climb above 1.3150 but it dropped again afterwards.

- Current range: 1.3080 to 1.3150.

- Further levels in both directions: Below: 1.3080, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2620.

- Above: 1.3150, 1.3212, 1.3280, 1.333, 1.3430, 1.3486, 1.3550 and 1.3615.

- 1.3080 is immediate and strong support. Note that 1.30 is a psychologically important number, but doesn’t offer much support.

- 1.3280 proved to be strong on the upside once again.

Euro/Dollar awaiting the Fed – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:30 French CPI. Exp. +0.4%. Actual +0.4%.

- 10:00 German ZEW Economic Sentiment. Exp. +10.6 points. See how to trade this event with EUR/USD.

- 10:00 Euro-zone ZEW Economic Sentiment. Exp. +3.8 points.

- 11:30 ECB president Mario Draghi talks.

- 12:30 US Retail Sales. Exp. +1.1%. Core sales exp. +0.8%.

- 14:00 US Business Inventories. Exp. +0.5%.

- 14:00 US IBD/TIPP Economic Optimism. Exp. 53.2 points.

- 18:15 US Rate decision (with statement). See 4 possible options awaiting the Fed.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- QE3 Lite or Operation Twist++: Given the recent excellent Non-Farm Payrolls, which also showed an improvement which Bernanke follows more closely, the chances of an outright QE3 are very low, but still on the table. The Fed extended the pledge for low rates until late 2014 last time, and the highest chances are for no change in policy. The Fed has at least two more interesting options. See the FOMC Preview for more.

- Still awaiting final approval: Even though Greece completed the PSI successfully and the new estimation is that Greece will now reach a debt-to-GDP ratio of 117% in 2020, the EU still needs to provide a final green light. This is set for Wednesday. The IMF will decide on its contribution on Thursday. Greece already concentrates on politics towards the upcoming elections.

- Officially in default: Moody’s joined other rating agencies and put Greece in default. After long hours, ISDA finally acknowledged that the use of CACs means a credit event, and that Credit Default Swap contracts will be paid. This had a very small effect on markets so far.

- Worries from China: The economic giant joined its neighbor Japan and posted a huge trade deficit. This weighs on the “risk environment” and helps the US dollar.

- PSI – deadline open for foreign law bonds: Greece completed the PSI for Greek law bonds. The new ones are already trading at a quarter of a euro on the euro, reflecting a high chance of another default. There is a small portion of bonds under international law. The deadline for the PSI on these bonds is March 23rd. Note that there are specific bonds that include a loophole – one that could still cause a delay

- Portugal will struggle to return to the markets: While Portugal is probably successful at implementing the program, it will find it hard to return to the markets, after Greece has defaulted and after the private sector got a haircut, while the official sector didn’t.

- German ministers wants Greece to go: In a passive aggressive move, German finance minister Wolfgang Schäuble said that he will respect countries who want to leave. Greece doesn’t want to leave, but there’s a growing notion that it is pushed to declare bankruptcy. This joins the words of Hans-Peter Friedrich that said he would advise Greece to leave the euro-zone and said that Greece should be “made an offer it can’t refuse” to leave.

- Draghi warns about inflation: The ECB left rates unchanged and made no policy changes. In the press conference, Draghi was very satisfied with the LTROs. He also warned about inflation, and said that the ECB has tools to fight it.