Euro dollar moved lower and stabilized at lower ground, capped under a lower resistance line. Participation in the Greek PSI remains the key as the deadline looms. Another significant hint towards the US Non-Farm Payrolls awaits us, as tension mounts.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

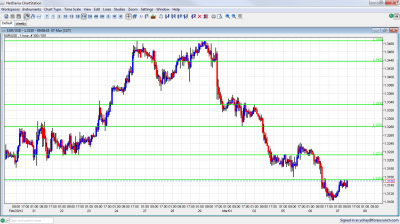

EUR/USD Technicals

- Asian session: A relatively quiet session sees the pair move slowly above the lows, but under resistance.

- Current range: 1.3050 to 1.3150.

- Further levels in both directions: Below: 1.3050, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2620.

- Above: 1.3150, 1.3212, 1.3280, 1.333, 1.3430, 1.3486, 1.3550 and 1.3615.

- 1.3212 is stronger resistance above.

- 1.3150 was indeed weak as support. 1.3050 is stronger.

Euro/Dollar in lower ground – click on the graph to enlarge.

EUR/USD Fundamentals

- 11:00 German Factory Orders. Exp. +0.6%.

- 13:15 US ADP Non-Farm Payrolls. Exp. +204K. See how to trade this event with USD/JPY.

- 13:30 US Nonfarm Productivity (revised). Exp. +0.8%

- 13:30 US Unit Labor Costs (revised). Exp. +1.2%.

- 20:00 US Consumer Credit. Exp. $10 billion.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- Greek PSI in doubt: The bond swap, in which private bondholders “volunteer” to lose around 74% of the bond value promised by Greece, is planned to end on March 8th. A participation rate of under 75% will be extremely problematic, as the Collective Action Clauses would not be triggered and the whole deal will fall. Greece says it is getting good signs, but might have to use the CACs, making the it less voluntary. Despite some public support, hedge funds remain quiet. The doubts certainly hurt the euro.

- Portugal will need another bailout: The details of the Greek deal, whether implemented or not, will likely weigh on Portugal, together with the recession. Once Greece is out of the limelight, Portugal will enter.

- Don’t forget the prior actions: Hopefully assuming that the bond swap will go through, the final approval for the release of EU funds is planned for March 9th or 12th. Euro-zone finance ministers noted that Greece made a lot of progress. Nevertheless, they are waiting for the bond swap to finish and for a “final assessment”. ThThe March 20th deadline is getting too close. Here are 5 hurdles that could further delay or cancel the bailout.

- ISDA Doesn’t Call Default: The international body responsible for deciding if there was a default or not decided not to declare a credit event for now. They left the door open to more questions and a different decision, and noted the “evolving situation” in Greece.

- German ministers wants Greece to go: In a passive aggressive move, German finance minister Wolfgang Schäuble said that he will respect countries who want to leave. Greece doesn’t want to leave, but there’s a growing notion that it is pushed to declare bankruptcy. This joins the words of Hans-Peter Friedrich that said he would advise Greece to leave the euro-zone and said that Greece should be “made an offer it can’t refuse” to leave.

- Spain defies the EU: The Spanish government lowered growth forecasts and presented a budget with a deficit of 5.8%, higher than the EU target of 4.4%. Pessimistic forecasts are good news, but the high deficit won’t go well in austerity focused Brussels.

- ECB LTRO II: Around 800 European banks grabbed nearly 530 billion euros. They are now better equipped for a crash and European leaders can feel safe and let go of Greece. The side effect was that banks accumulated sovereign bonds as collateral for the operation.

- Plan B still possible: Despite the deal, things, such as the IMF contribution or more Greek misses, could still go wrong. There are reports about plans made in Germany and the US for a Greek bankruptcy on March 23rd, when Athens will raise a white flag and a bank holiday will be announced. Here are 5 more ominous signs that Greece is pushed to the corner.

- US Housing still sensitive: The sensitive housing sector has shown minor improvement via the existing home sales figure . Single family houses are still struggling, as well as foreclosures. The trend of falling jobless claims, at least in the 4 week moving average continued.

- OK Employment Report expected: Friday’s Non-Farm Payrolls could be decisive for QE3. Various important indicators lead up to the NFP. In Bernanke’s latest testimony, he said that the improvement in employment surprised him. This was enough to boost the dollar, big time. The important services sector PMI exceeded expectations but the employment component showed slower growth. Today’s ADP report should be taken with a grain of salt, but still provides a general picture about the trend.