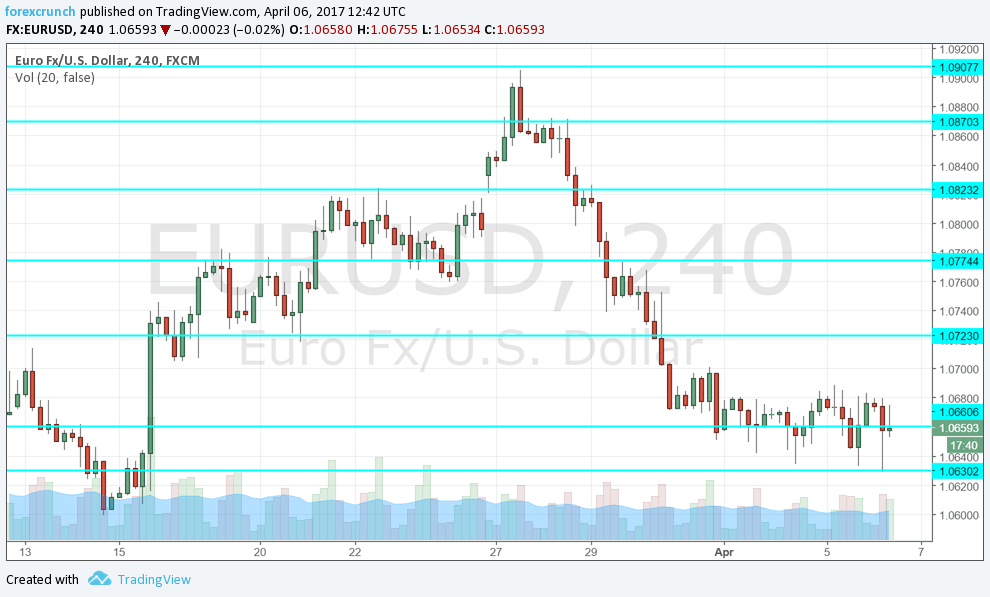

EUR/USD is entrenched in a range, but at least it is a predictable one. After an attempt to move to the upside, the pair dropped back down within the well-known levels before hitting 1.0630. For the third time in recent days.

The reason for the downfall came from the President of the ECB Mario Draghi. Contrary to some of his more upbeat colleagues, the Italian head of the Frankfurt-based institution seems reluctant to withdraw monetary stimulus.

He said that a reassessment of monetary policy is not warranted. Others want to end bond buys this year or even begin raising rates before QE reaches its end.

Here is a key passage from his speech:

Before making any alterations to the components of our stance – interest rates, asset purchases and forward guidance – we still need to build sufficient confidence that inflation will indeed converge to our aim over a medium-term horizon, and will remain there even in less supportive monetary policy conditions.

In the meantime, US data came out better than expected: weekly jobless claims dropped to 234K. The fall came after a few worrying months on higher ground. In theory, this should have helped the pair drop under 1.0630, but it never materialized.

Does the resilience of the single currency imply it is heading for a big rally? A lot depends on the US jobs report tomorrow. See how to trade the NFP with EUR/USD.