Euro/dollar is at a fresh 3 month low, challenging low support after opening with another Sunday gap. Last minute talks in Greece to form some kind of unity government haven’t succeeded so far, and fresh elections seem likely. Talks about preparations for a Greece leaving the euro-zone are heard from more and more places. In addition, Spain’s rising bond yields also weigh on the common currency. Spain and Italy will both raise money today in the markets, in another test.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

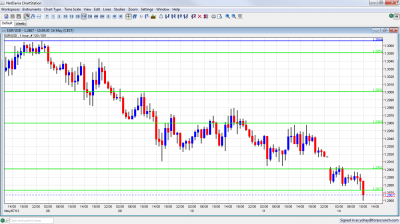

- Asian session: The pair opened with a gap at 1.29, and continued lower, challenging the 1.2873 line in the European session.

- Current range: 1.2873 to 1.29.

- Further levels in both directions: Below: 1.2873, 1.2760, 1.2660, 1.2623 and 1.2587.

- Above: 1.29, 1.2960, 1.30, 1.3050, 1.3110, 1.3165, 1.3212, 1.33 and 1.34.

- For a second week in a row, a weekend gap is seen. This gap wasn’t closed quickly (again) and this is a bearish sign.

- 1.2960 is strong support above.

- 1.2873 is the next support level before. The move under this line is not confirmed yet.

Euro/Dollar gaps lower – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German WPI. Exp. +0.3%. Actual +0.5%.

- 8:40 Spanish 12 and 18 month bond auction. Results: Spain raised 2.9 billion at higher yields than last time.

- 9:00 Euro-zone Industrial Production. Exp. +0.5%.

- 9:10 Italian 3, 8 and 10 year bond auctions.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Greek talks fail: The president of the Hellenic Republic tried bringing the parties together after 3 party leaders failed to form a government. A unity government to renegotiate the bailout seemed close as moderate Democratic Left was willing to join mainstream parties, but it conditioned it on the participation of SYRIZA – the radical left-wing party that wants to cancel the memorandum. SYRIZA, which came out second in the elections, is enjoying higher popularity and prefers elections. There still might be some agreement, but for now, a second round of elections seems likely on June 10th or June 17th.

- Grexit preparations: There are reports that Vodafone is sending cash deposits from Greece to Britain every night. German finance minister Wolfgang Schäuble, which told Greece it has to chose between staying or leaving, mentioned preparations for a Grexit by his ministry. ECB member Patrick Honohan of Ireland said the impact “could be technically managed” but would hurt confidence in the zone. Also his colleague Luc Coene of Belgium discussed this opportunity. It would not be surprising if Greece is already secretly printing drachmas.

- Merkel defeated in regional elections: For a second consecutive week, Merkel’s CDU party is defeated in local elections. Yet this time, it’s the largest state: North Rhine Westphalia, where one fifth or Germany’s population lives. Her candidate, Norbert Röttgen, campaigned on austerity measures, suffered a big defeat and resigned. This doesn’t bode well for Merkel’s austerity drive.

- Spain working on Plan C: Only days after Spain nationalized Bankia and introduced new measures for the banking system, it was revealed that a plan for a worsening situation is underway. While details are unknown, it is fair to say that the situation is deteriorating and could be worse than expected. Spanish 10 year bond yields are leaping to 6.26%, with the spread from German benchmark bunds reaching 4.77% – these are extreme levels.

- Merkel and Hollande kick off: François Hollande will start his presidencyon Tuesday morning and fly to Berlin in the afternoon to meet Angela Merkel. The first meeting might be difficult due to the anti’austerity path Hollande is leading now, but eventually Germany will have to bend.

- Deeper recession in Europe: The European commission left the contraction forecast unchanged at 0.3%. But the details make a difference: Germany is expected to grow by 0.7% (up from 0.6%) while Spain is expected to squeeze by 1.8%, much worse than the previous estimate of 1%.

- US Economy OK: The data form the US is mixed, but still pointing to growth, contrary to the old continent. The recent good news is that jobless claims are back to previous levels in the very sensitive job market. US indicators will probably have an impact later in the week

- QE3 Move by Fed Unlikely: Balance sheet measures are still on the cards (QE3) according to the Bernanke, but a significant deflation or no growth can revive the chances of more dollar printing. QE3 is currently on the back burner. A “hands off” policy of low interest rates for the foreseeable future may not make for dramatic moves in market, but it is supportive for the greenback.