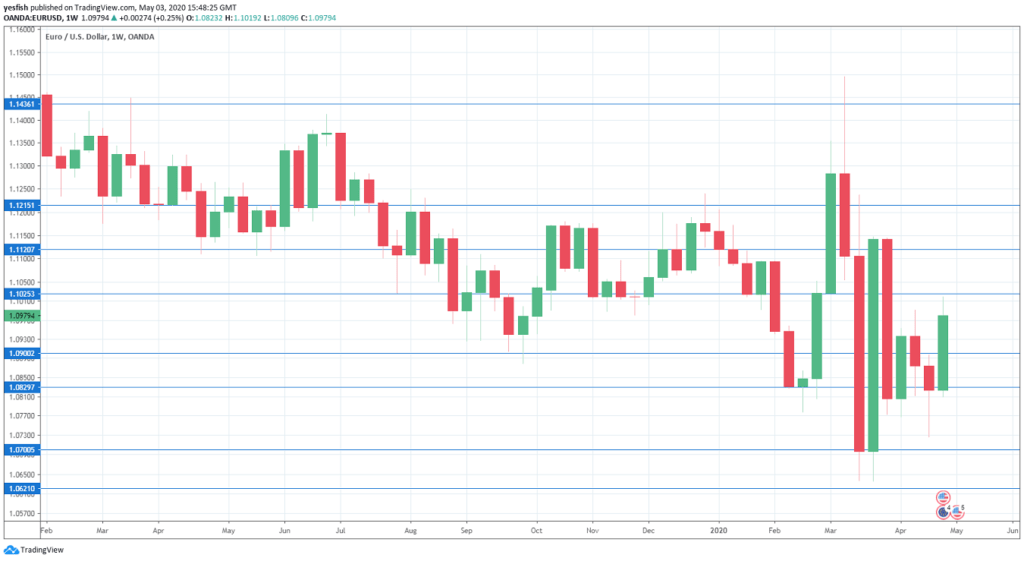

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday: 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. Markit’s forward-looking purchasing managers’ index for Spain’s manufacturing sector has been in contraction mode for nine of the past 10 months, and the trend is expected to continue in April, with an estimate of 35.0 points. In Italy, the PMI is projected to slow to 30.3 points. The German indicator has been in contraction since December 2018 and is expected to fall to 34.4 points. The eurozone PMI slipped to 44.5, its weakest reading since 2012. The estimate for April stands at 33.6 points. France slipped to 43.2 and the estimate stands at 31.5 points.

- Sentix Investor Confidence: Monday, 8:30. Investor confidence plunged in March, falling to -42.9 points. This was down from -17.1 a month earlier. Another sharp decline is expected, with a forecast of -25.9 points.

- Spanish Unemployment Change: Tuesday, 7:00. Unemployment claims hit Spain like a tsunami in March, with a staggering reading of 302.3 thousand. This crushed the estimate of 27.7 thousand. Will we see a dismal reading in April as well?

- PPI: Tuesday, 10:00. The Producer Price Index declined by 0.6% in February, missing the estimate of -0.3%. This marked the first decline in six months. Another weak reading is expected in March, with an estimate of -1.2 percent.

- German Factory Orders: Wednesday, 6:00. This indicator has sputtered, with four declines in the past five months. The indicator posted a loss of 1.4% in February and is expected to plunge by 10.0% in March.

- Services PMIs: Wednesday, 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German one at 7:55, and final euro-zone number at 8:00. March was an absolute disaster, as the services sector contracted sharply. The German PMI slipped to 31.7, down from 52.5. This was the first reading below the 50-threshold since 2012. The eurozone indicator slid to 26.4, down from 52.6 points. The Spanish, Italian and French numbers were also sharply lower. The April numbers are expected to be even worse – 10.0 in Spain, 10.4 in France, 15.9 in Germany and 11.7 in the eurozone.

- Retail Sales: Wednesday, 9:00. Eurozone retail sales posted a strong gain of 0.9% in February, crushing the estimate of 0.1 percent. However, analysts are braced for a sharp decline in March, with an estimate of -11.2 percent.

- German Industrial Production: Thursday, 6:00. The indicator slipped to 0.3% in February. The forecast for March stands at -7.3 percent.

- French Trade Balance: Thursday, 6:45. France posts trade deficits on a continual basis. The deficit narrowed to EUR -5.02 billion in February, down from EUR -5.9 billion a month earlier. Will the deficit continue to improve in March?

- German Trade Balance: Friday, 6:00. Germany’s trade surplus widened to EUR 21.16 billion in February, up from EUR 18.5 billion a month earlier. This was the highest surplus since May 2018. The upturn is expected to continue in March, with an estimate of EUR 20.1 billion.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1435 was tested in resistance in mid-March.

1.1215 has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) is under pressure in resistance.

1.0900 has switched to a support role after strong gains by EUR/USD last week.

1.0829 is next.

The round number of 1.07 saw action in mid-March, when EUR/USD showed strong volatility.

1.0620 is protecting the 1.06 level. This is the final support line for now.

.

I remain bearish on EUR/USD

This week’s economic numbers are expected to be dismal, reflecting deteriorating conditions across the eurozone due to the Covid-19 outbreak. This could weigh on the euro.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week