EUR/USD is on the move. After hesitating and making baby steps above the former resistance line of 1.1445, the pair finally takes a bigger step. Euro/dollar is well above 1.15 and has set a high at 1.1538.

The main driver of the pair is Trumpcare. The failure of Senate Republicans to pass a bill to repeal and replace Obamacare set a new round of USD sell-off. The greenback has already been under pressure after weaker inflation and retail sales data, as well as caution from the Fed Chair Janet Yellen.

Trump already got in trouble because of his son, and now his policy is suffering without him doing anything. More Senators have announced they would reject the amended bill, which was a nod to moderates. The health issues of Senator McCain also weigh, as the Republicans have a slim majority in the upper house.

The announcements by further Senators, Mike Lee and Jerry Moran, that they will reject the bill triggered a wide sell-off of the dollar. AUD/USD reached the highest in two years, USD/CAD dropped to lower ground and also the euro enjoyed it.

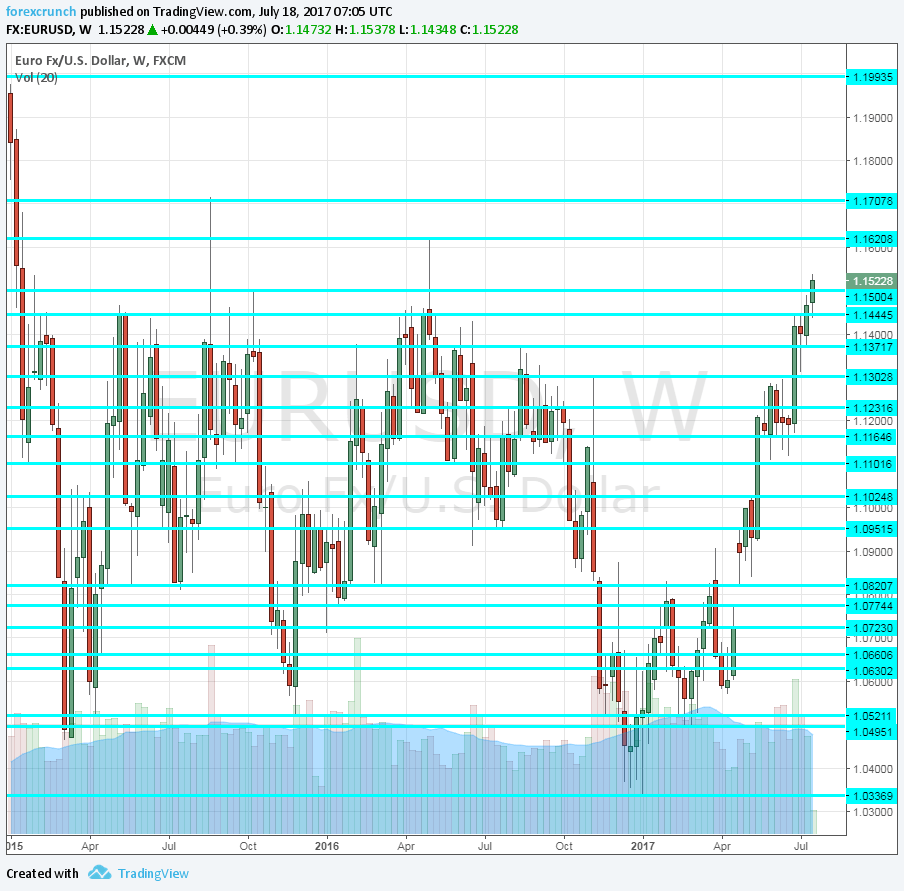

EUR/USD levels

It is uncommon to see euro/dollar, the world’s most popular currency pair, make a big move in the Asian session. The pair was trading just under the previous line of resistance at 1.1490, one of those baby steps on the way up. This level now turns into support.

The next level to watch out for is 1.1620. It was the 2016 high seen in May last year and a clear barrier on the way up. We are still far from it.

If the pair gains momentum and makes the break, the next level to watch is the 2015 peak at 1.1712. It was a swing high in August that year when Chinese stocks crashed.

Further above, it is hard to find any meaningful levels until the round level of 1.20. Given the recent hesitation of the pair, it may be hard to reach these levels without a push from the ECB, that is wary of another move higher.

More: EUR/USD: Dips To Prove Shallow; Where To Target? – Danske

On the downside, we find 1.1445 after 1.1490. The next level of support is 1.1370, a recent low, with 1.13 serving as a more significant cushion.

Here is the weekly chart: