EUR/USD is hugging the 1.10 line, looking for a new direction after the moves by the ECB and the FED.

What’s next? The team at Goldman Sachs describes the adaptive expectations:

Here is their view, courtesy of eFXnews:

In a note to clients, Goldman Sachs discusses its outlooks and forecasts for EUR/USD arguing that the term ‘adaptive expectations’, which describes how new information gets incorporated in the price formation with a lag, can explain EUR/USD recent price action and project its next direction.

Into last week’s FOMC, GS notes that there was some dismay that EUR/USD had not seen more follow-through since the ECB surprise. GS thinks history helps put things in perspective.

“On September 4, 2014, the ECB surprised markets by cutting the deposit rate and President Draghi used the press conference to announce that the central bank’s balance sheet would be “steered” to early 2012 levels, essentially pre-announcing sovereign QE. Nonetheless, EUR/$ fell only two big figures (from 1.3150 to 1.2950) on the day, doing little more than price the deposit cut. It was only thanks to a hawkish FOMC in December that EUR/$ finally broke below 1.25 in a convincing manner, i.e., it took 3-4 months for EUR/$ to grind five big figures lower,” GS notes.

Why this delay and what does it mean for today? GS thinks the term “adaptive expectations” describes price formation in markets well, in particular the idea that new information gets incorporated with a lag.

“Much like the new information in September 2014, we think recent signals from the ECB (revising inflation and growth forecasts lower in September and putting December on markets’ radar last week) are deliberate and point to more stimulus,” GS argues.

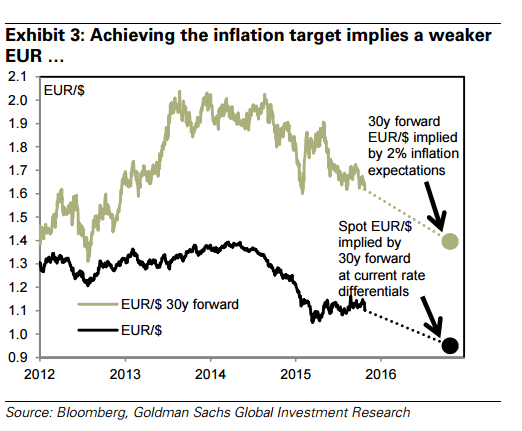

“After the painful period since March, it will take time for markets to trust this message once again, i.e., “adaptive expectations” will once again delay the adjustment in EUR/$, which we see going to 1.05 ahead of the December 3 meeting,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.