Euro/dollar lost around 20% from the highs in early May. After the recent drop, has it found a bottom?

Not yet. The team at BNP Paribas revised the targets to the downside.

Here is their view, courtesy of eFXnews:

The speed of EUR/USD’s decline since the start of the year is causing investors to question the size, direction and catalyst for the next EUR move, notes BNP Paribas.

Real yields should continue to move against the EUR:

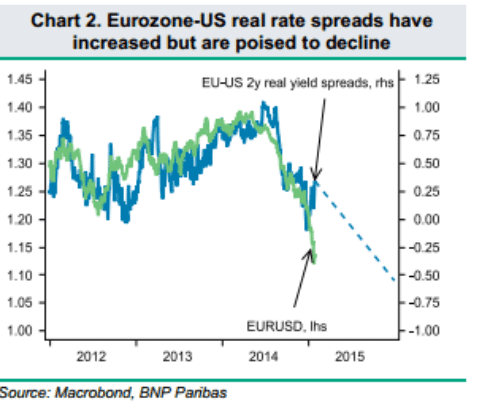

“The ECB’s quantitative easing programme exceeded the markets’ high expectations…So far, however, the follow-through from higher inflation expectations has been lacklustre, with the 5y5y breakeven inflation rate falling to around 1.60 after rising above 1.80 in the aftermath of the ECB announcement,” BNPP adds.

“Nevertheless, we would highlight that the move higher of this measure is likely to be gradual as QE feeds through to the real economy, rather than a knee jerk reaction. As a result, our forecasts indicate gradual declining real yield support for EURUSD,” BNPP argues.

Positioning analysis indicates scope for further EUR shorts over the medium-term:

“The speed at which short EUR positioning has increased suggests that there may be room for short-term profit taking. However, from a longer-term perspective, bearish EUR positioning does not yet appear to be extreme. In particular, the ‘client exposure’ component of our analysis has a score of only -8,” BNPP notes.

“We view that with FX investors appearing to hold light bearish EUR positioning, there is scope for the EUR to be sold on rallies,” BNPP argues.

ECB QE to encourage further debt outflows:

“Looking ahead, we expect the trend of debt outflows to accelerate as ECB QE weighs on real yields,” BNPP projects.

In line with this view, BNPP revised its EUR/USD targets to 1.13 by end of Q1, 1.10 by end of Q2, 1.08, by end of Q3, 1.05 by end of Q4 and to 1.00 by end Q1 of 2016.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.