EUR/USD managed to bounce very nicely from the Italian referendum result and looks further away from parity. What’s next?

Here is their view, courtesy of eFXnews:

The Italians voted ‘No’ in the constitutional reform referendum, and do so in resounding fashion, with a 59-41 outcome estimated. The polls had indicated a ‘No’ win but the scale (and turnout) leave no doubt that this wasn’t just a vote about constitutional reform. The antiestablishment wind blowing through global politics hasn’t died down (even if the Austrians chose Green over Freedom Party in the Presidential election…).

EUR/USD briefly touched 1.0506 this morning, but because the vote was largely expected, there really wasn’t enthusiasm to push the move too far as the pair staged a recovery.

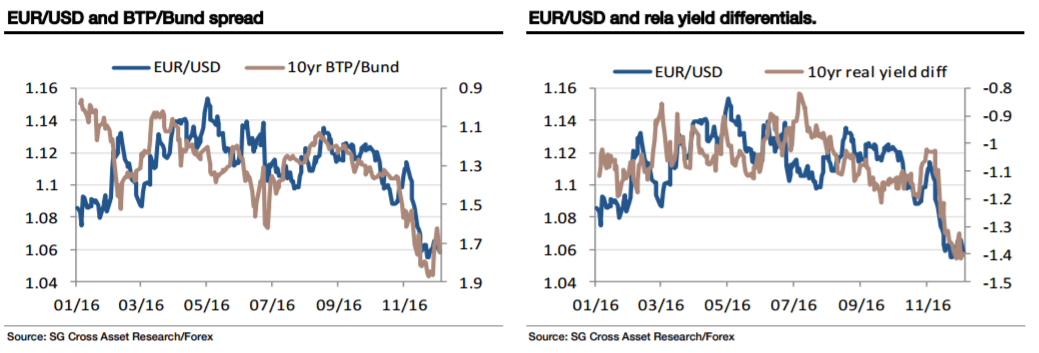

From here, FX will take its cue from the BTP/Bund spreads, the equity market reaction, and wait for rating agencies to opine. There is a Finance Ministers’ meeting in Brussels and the big event of the week is Thursday’s ECB meeting when an extension to ECB bond-buying is likely to be announced (but possibly without any direct reference to how much they buy each month, hinting at tapering).

All in all, major EUR downside isn’t likely this month, but we do still expect a move to parity between now and the French Presidential elections as voter anti-establishment sentiment erodes confidence.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.