EUR/USD has been wobbling between mixed data and Trump’s messy start. What’s next?

Here is their view, courtesy of eFXnews:

US policy uncertainty and Fed-ECB monetary policy divergence are likely to continue alternating as drivers of the EURUSD in the short term.

This week, the FOMC meeting could remind markets that risks are titled in the long-run towards a stronger dollar, through the possibility of more rate hikes, but the White House unpredictability has led investors to pare back short EURUSD positions since the beginning of the year.

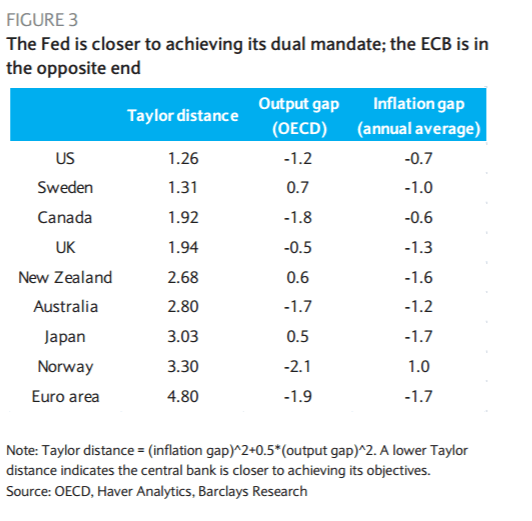

The most important event will likely be the FOMC meeting on Wednesday in which we do not expect any change in policy. In this regard, our economic team recognizes that there was a notably hawkish shift in tone from the Fed at its December meeting. In addition to believing that cumulative progress toward the dual mandate justified a rate increase, the FOMC views signaled that monetary policy will not be passive in the face of expansionary fiscal policy. We expect no change in the target range for the federal funds rate this month. Instead, we believe that the statement will reflect the view that the labor market is at or near full employment. Regarding inflation, we look for a modest upgrade to reflect recent trends, but believe the committee sees this as mainly a mechanical passing of base effects from energy prices and currency movements. At the moment, markets (fed fund futures), price in a 70%+ probability of two hikes, roughly in line with Barclays expectations in 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Our previous analysis of consensus trades (short EURUSD is one such trade this year) suggests that the poor performance is likely to stay for some more weeks. The political risk in Europe is likely to reassert itself more firmly on this pair as we approach the Dutch general election (15 March), where risks have been underestimated by markets, in our view

In addition, the January employment report will be published as usual on Friday. We forecast non-farm payroll to have increased 175k in January, a pick up from the December slowdown. We forecast for the unemployment rate to decline one tenth to 4.6%. We expect average hourly earnings to increase 0.3% m/m and for the average weekly hours to be unchanged at 34.3.