Brexit is reality: the UK voted to leave the EU and markets are reacting. The biggest currency impact is seen in the fall of British pound, crashing over 10% at some point against the dollar. The uncertainty about the future of the UK outside the EU and the fears of a recession has an immediate impact.

But this divorce decision also has an impact on the other side: the European Union. And this has implications on one of the EU’s biggest projects, the single currency. Uncertainty about the 19 economies of the euro-area and its fate weigh on the common currency.

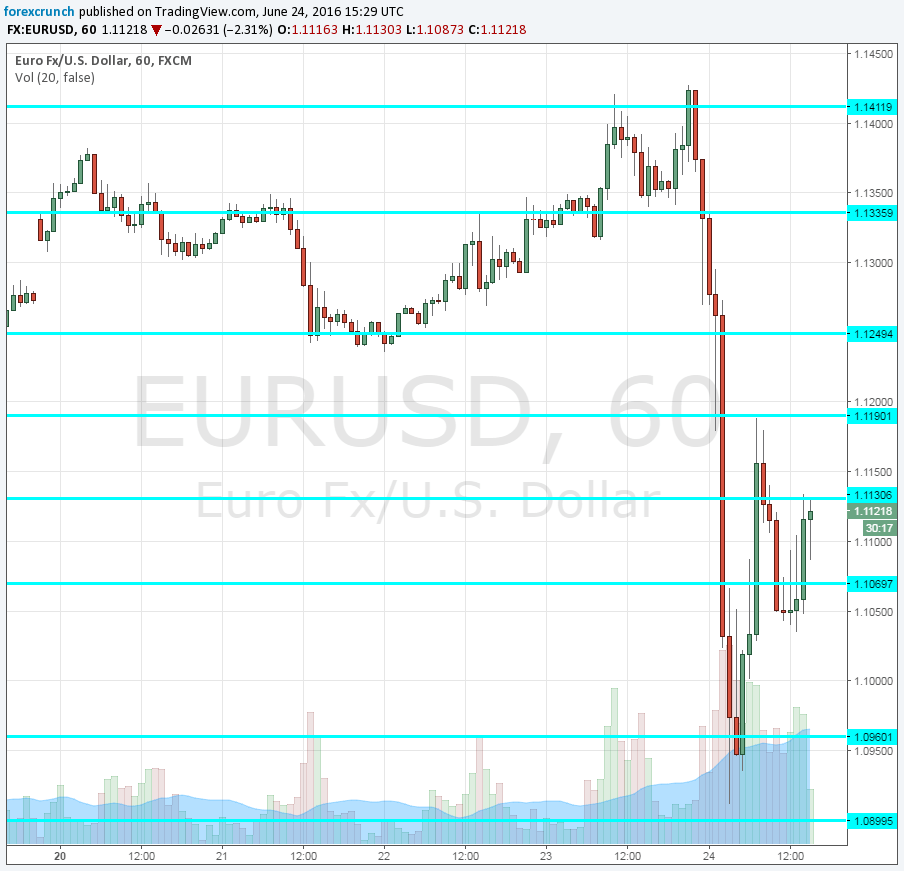

Immediate post Brexit EUR/USD action

EUR/USD dropped as low as 1.0910 in the aftermath, down from a peak of 1.1427. Yet forex trading is never a one way street and a big bounce followed. At the time of writing, we are at 1.1111.

The pair hit resistance at 1.1190 after the big fall. Further resistance awaits at 1.1250, which provided support before the crash. The next lines are 1.1335, 1.1410 and strong resistance awaits at 1.11460.

But the direction may well be to the downside. The first line to watch is a Draghi inspired high of 1.1070. Further support is at 1.10, which is a very round number. Further below, 1.0910, the swing low, is the next line.

What’s next?

All in all, this is a very negative event. It could be the beginning of the end for the monetary union that already suffers from banking crises and sovereign crises. The economic recovery is already quite fragile and investment is very weak. Unless the euro-zone and especially Germany get their act together and begin investing, it is hard to see an upside any time soon.

The next round of elections is just around the corner. Spaniards go to the polls on Sunday for the second time in 6 months. The previous round ended in a hung parliament. We may have a repeat of a hung parliament according to polls, but nothing is certain.

Things may further worsen for markets: the left-wing and slightly euro skeptic Podemos party could come out first. This doesn’t mean an imminent anti-euro government, but yet another headache and yet another reason to sell the euro. Spain is the euro-area’s fourth largest economy.

But even if Spain does not move markets, the event is certainly a “sobering” one to say the least. Once the dust settles from the extreme volatility we are witnessing now, the euro could continue lower.

EUR/USD lower levels

1.0820 was the Draghi low of March and works as strong support. Further below, we find 1.0710 that served as a double bottom. These are significant hurdles.

Lower, we have 1.0630, which was temporary support when the pair traded at lower ground. It is followed by 1.0520, the low level we have seen in December 2015. The next line is the 2015 low which is also the trough of a decade: 1.0460.

Again, it is unlikely to see a spectacular crash in the value of the euro very soon, but rather a more gradual slide: a catch up of the currency with reality.

More: Brexit – all the updates

Here is the chart: