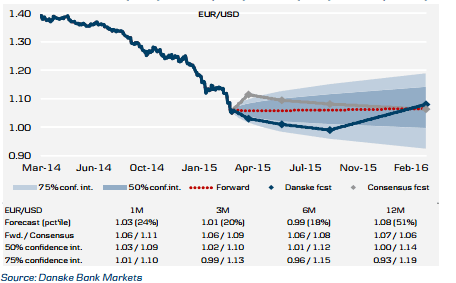

EUR/USD is currently hugging the 1.06 level in anticipation of the Fed. Where will it trade afterwards? And what flows impact the pair?

The team at Danske provides these charts and explanations:

Here is their view, courtesy of eFXnews:

ECB QE fuels EUR outflows via two channels:

− The combination of rising excess liquidity and negative deposit rates in the eurozone is driving investors towards riskier assets in a search for yield. This is EUR negative through two channels.

1. We expect the search for yield to include non-EUR assets and thus drive EUR selling.

2. We expect European equity outperformance to lead investors to hedge (at least part of) their returns and thus drive EUR selling. −

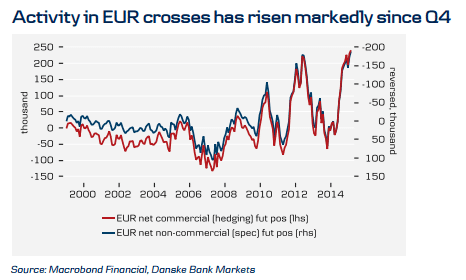

Speculative EUR shorts have risen significantly since Q4 as has the level of net commercial EUR positioning. The latter is a hint that foreigners are now hedging EUR income/assets on a larger scale than in ‘normal’ times.

Two factors to define the bottom for EUR/USD

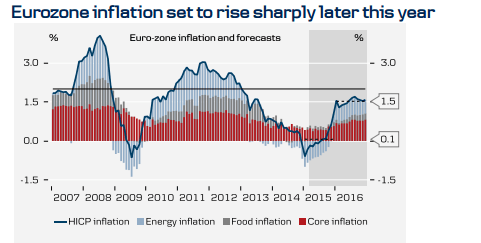

1. Eurozone inflation: while euro-zone core inflation is likely to fall further, our forecasts suggest that headline inflation stands to see a more a more significant upturn than the markets expect at present. When this is seen, probably during the autumn, EUR downside should fade.

2. Fed policy normalisation: on the one hand, we think the market is currently pricing too little Fed tightening (implying more USD strength near term); on the other hand, we think the Fed will eventually go slower on hikes than the market will be pricing at the start of the cycle.

Forecast: 1.03 (1M), 1.01 (3M), 0.99 (6M), 1.08 (12M).

Conclusion. We expect a soft EUR/USD over 3-6M, as the effects of ECB QE and the warm-up to Fed policy normalisation continue to weigh. However, the EUR weakness now playing out and a lower level of oil prices and improved credit conditions should pave the way for the ECB to become less dovish earlier than the market expects. Coupled with our view that a repricing of the Fed will happen mainly ahead of a first hike over the summer, the potential for upside to US rates is limited beyond 6M. As the sell-off in the cross has been more dramatic than previously imagined and the QE effect more EUR negative up front, we have adjusted our forecasts but maintained the same profile.We see the cross below parity in 6M before moving higher on 6-12 months

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.