Is EUR/USD headed for a reveral after the recent fall?

And what does it take? The team at Nordea provides a full technical explanations:

Here is their view, courtesy of eFXnews:

The following is Nordea Markets’ latest outlook and forecast for EUR/USD as provided by Aurelija Augulyte, a senior analyst at Nordea.

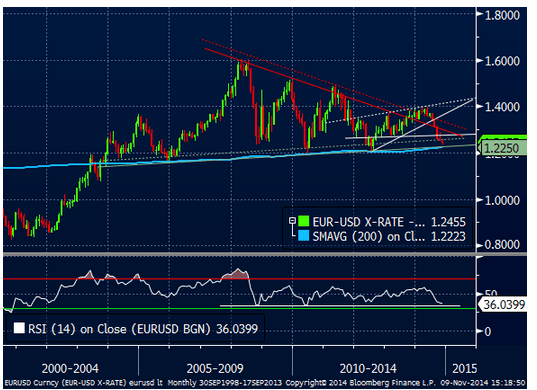

Another week, another sugar rush for the USD. Again and again, people being caught off guard betting on the reversal. But the EURUSD is now close to very significant levels technically, as noted before, 1.2250-1.2350 is a major test area. Any chance?

Figure 1. Getting there

What does it take for the reversal to happen?

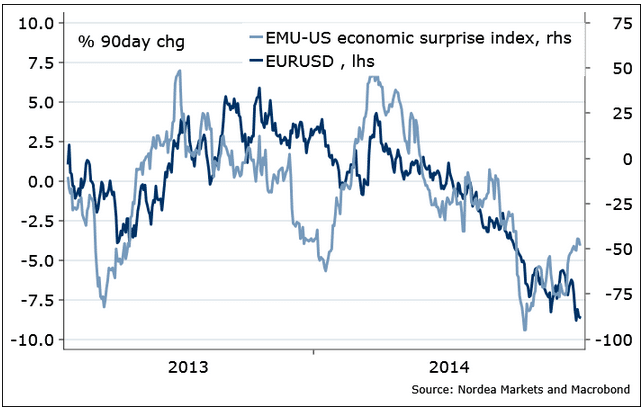

Firstly, stabilizing / improving EMU macro data. This week we will get GDP numbers, likely weak Q3, maybe even slight contraction (q/q). But that’s old news by now, and not unexpected, and relative surprise index has turned up (Figure 2). Looking past Q4, there is some hope: e.g. the PMI data for the CEE, “German backyard”, has picked up; the money and credit data suggests a rise in EMU PMIs in H1 2015; retail sales will be supported by low inflation; a number of indicators suggests at least stabilizing core inflation, which should put a floor on EUR rates from here. Shouldn’t it?

Figure 2. Bad news from euro zone is no news any more

Secondly, China foreign reserve growth. We have observed the pattern of the EURUSD rising when the Chinese reserve accumulation picks up (Figure 3). In Q3, China’s reserves fell by USD105bn, largest decline ever. Why would it pick up now? It could both be for good reasons, and bad. The former, if China’s export growth picks up, and we have seen some signs lately. The latter, if the PBoC tries to fend off speculators or weaken the currency due to domestic growth risks – that we observed early this year. Mind you, the USDCNY turned up in November (…amidst some regional concern about weaker JPY). Signal?

Thirdly, ECB (in)action. The tricky one. Even though the ECB was arguably more dovish last week (introduction of the balance sheet into the statement), the EUR was rather resilient. So, it seems if there is anything to make any difference, is either ECB backing off from QE completely, or the contrary, new / expanded QE in any form, which quite a few expect in December. Remember, my thesis has been that a massive ECB QE could be actually EUR positive (assumption: flow effect dominates inflation effect). Counterintuitive as it may sound.

Fourthly, better global growth outlook. Last week was move was about the USD and expectations of the stronger labour market report. A bit weird that the UST 10Y yield declined 10bps on what it seems to be a strong report – it appears, wage inflation, still tame, driving this market (Figure 4). But the UST yields should keep edging higher as wage growth picks up (our economist’s hope too), the stock market rises toward the year end, and oil prices stabilize on better growth data, including stronger consumption data in the US (this Friday – retail sales). That could be a challenge for the USD, but good news for Scandi currencies, commodity currencies, solid EMs, negative for the JPY and CHF

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.