EUR/USD is floating up and down. Where is it headed next?

Here is their view, courtesy of eFXnews:

The USD has been on the back-foot so far this year, largely reflecting the Fed’s fearful stance which is currently helping reflate global markets. The Fed will however become less nervous in coming months: i) financial conditions are now the easiest since August 2015, ii) “tipping point effects” from low low oil prices have receded given the 70 percent oil price rise from lows, iii) a Chinese growth pickup is another check mark on the Fed’s worry list, while iv) the jury is still out on inflation expectations (our analysis suggests lower risks, but we need somewhat more data (esp. the UMich survey) to sound the all clear).

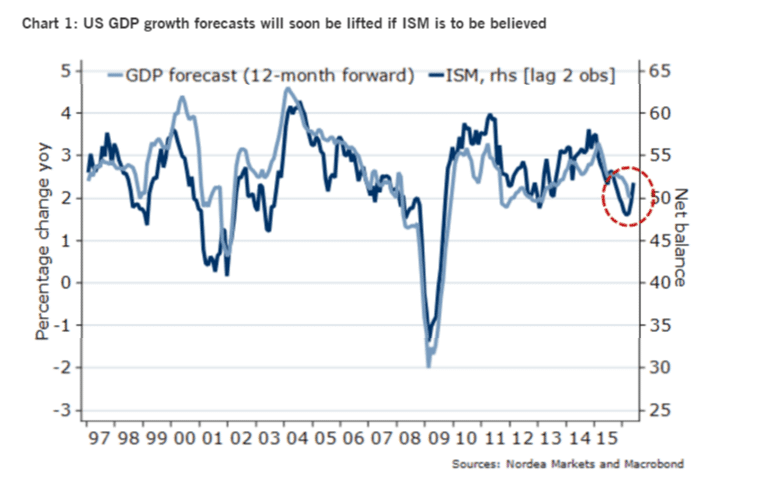

While the Fed may need to cut its 2016 growth forecast based on a weak Q1, the pick-up in ISM suggests economists lift their more forward-looking forecasts within months (chart 1). This should underpin psychology re: the US and the USD later this year. Despite these positives, the Fed is likely to see the risk/reward from potentially being perceived as too hawkish as fairly poor – given the binary risks stemming from e.g. a Brexit vote in June, but this doesn’t mean that the market’s pricing of the Fed’s future rate path (or the USD) isn’t a bit too muted currently.

In Europe, the Euro Area is likely to feel more headwinds from the stronger EUR, dampening manufacturing sentiment in relative terms. Price-action in bank equities still suggests downside risks to loan growth (and capex demand) later this year, despite the ECB’s credit easing efforts. If oil prices keep rising, as Nordea forecasts, this could delay or prevent the ECB from launching more stimuli (our economists see more ECB easing already in June/Q3).

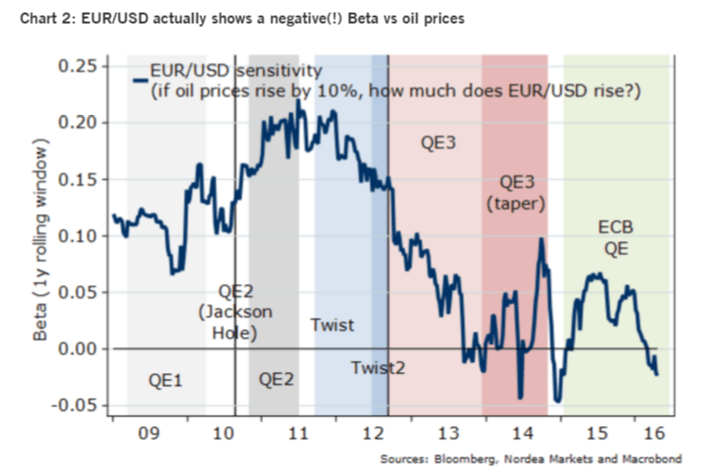

In this respect, do note that the oft-focused upon relationship between EUR/USD and oil prices currently suggest that higher oil prices are bad for the EUR(!) (a beta below zero, chart 2). Indeed, this may seem highly counter-intuitive, but some of the classical macro drivers may have changed due to geopolitics, the shale revolution, and more

We still believe that the so-called policy divergence theme remains alive, even though it has become markedly more muted vs markets’ expectations only a few months ago. In our view, the Fed will still need to slow down growth so as to prevent inflation and wage growth from eventually overshooting, and given this dynamic it remains the front-runner among G10 central banks.

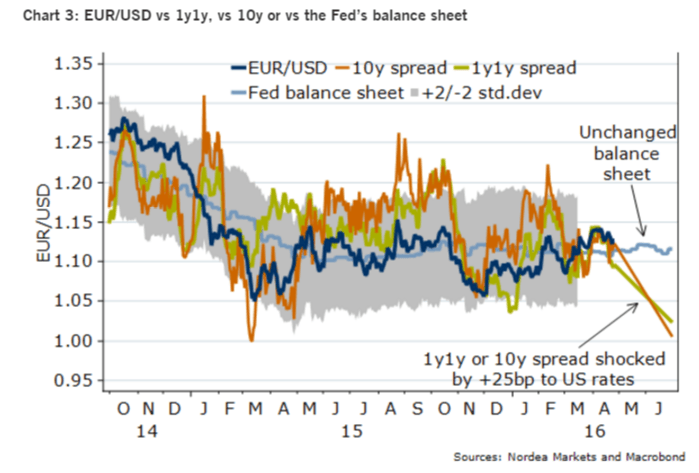

A gradual repricing of either the US long end or the short end is thus likely to weigh on EUR/USD down the line, which is why we still prefer to sell the pair on rallies than to buy on dips (chart 3).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.