EUR/USD is moving higher on optimism for a deal in the Greek crisis. Could this be a selling opportunity?

The team at Credit Suisse examine the charts and offer a nice risk reward ratio:

Here is their view, courtesy of eFXnews:

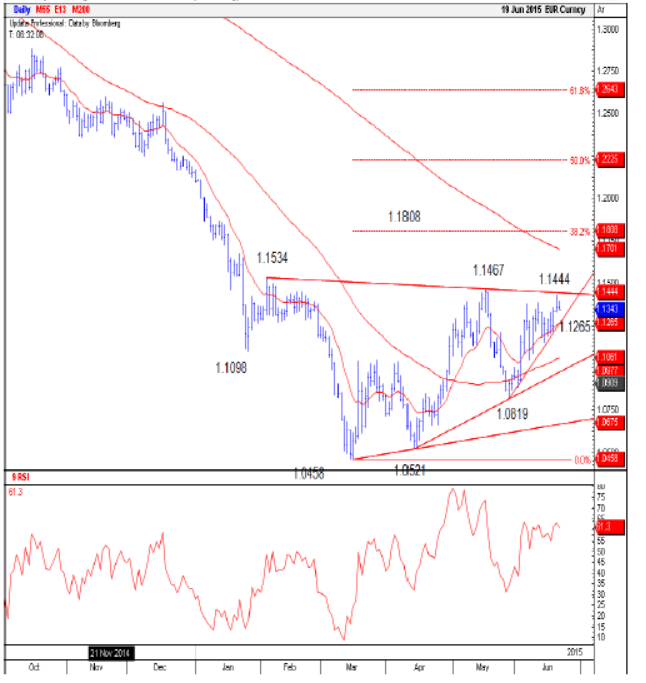

The spotlight in EUR/USD remains firmly fixed on the converging range highs at 1.1444/67, notes Credit Suisse.

“EUR/USD has pushed up through the 1.1386 recent high to test the converging range highs at 1.1447/67 before retracing lower. We again look for selling to be found here, for a reversion back into the range,”CS argues.

Direct extension above 1.1467, according to CS, would suggest a base is in place and a better recovery is underway for the 1.1534 February peak, then the 200-day average at 1.1709 with the tougher barrier seen at 1.1808/11

“Support moves to 1.1340/30 initially, below which can see a small top for 38.2% retracement support and the accelerated uptrend at 1.1291/65,” CS notes.

“Below this latter area is needed to suggest a better high may have been seen for 1.1207/01, ahead of 1.1151/32. Below here would aim at the mid-point of the range at 1.1052/35,” CS projects.

In line with this view, CS maintains a tactical short EUR/USD position from 1.1385, with a stop at 1.1467, and a target at 1.1055.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.