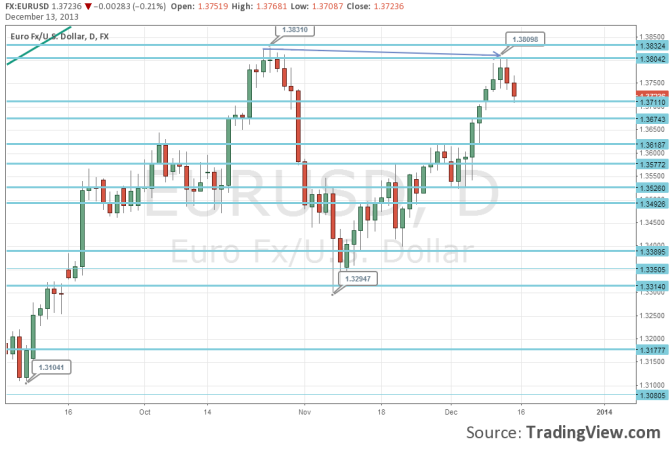

Looking at the daily chart of EUR/USD, we can clearly see a peak which is lower than the previous one. This comes after a series of higher highs and higher lows.

Is the pair just cautious before a potential “Dectaper” and could move higher anytime soon? Or, could this lower high indicate a big downfall in case QE tapering is announced? Here is how it looks on the chart:

EUR/USD reached a new 2013 high on October 25th, at 1.3832. It then fell sharply and bottomed out just under 1.33 on November 7th. This bottom was higher than the previous bottom of 1.3104 seen in September.

So, this bottom seemed like a healthy correction before another leg up to higher ground. However, the upwards move that began in early November, didn’t reach 1.3832 but stopped at 1.3810 on December 11th.

Chances for a tapering of bond buys in the US have been mounting: the NFP report was certainly positive, and so was one of the Fed’s best measures of jobs: JOLTS, which reached a 5 year high. In addition, a significant political hurdle was removed with the budget deal: there will be no government shutdown in the near future.

But will the Fed take the extra step?

For more lines and levels on EURUSD, see the Euro USD forecast.