EUR/USD has extended its losses and got close to support at 1.0340. Can it continue to parity? Many think so. But there is no clear consensus. Here is the outlook from Danske, which sees a trough within a month.

Here is their view, courtesy of eFXnews:

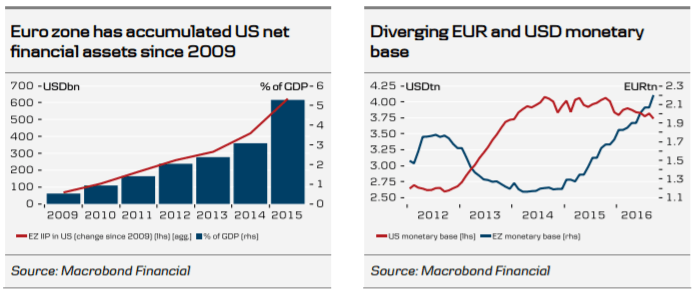

Short term (1-3M horizon): In the short term, on the one hand there will be downward pressure on the US monetary base from the higher federal funds target and from the impact of new banking regulation with US banks set to be required to have an LCR of 100% by 1 January 2017. On the other hand, deposits on the US treasury account may fall at the beginning of next year after a resuspension of the debt ceiling, which will tend to increase the monetary base. Overall, this is likely to be marginally positive for USD and weigh on USD FX forward points vis- Ã -vis EUR and the Scandinavian currencies on top of the impact of the repricing of the path of Federal Reserve rate hikes, e.g. keeping the 3M EUR/USD basis spread around the present 70-80bp, and thus maintaining a significant negative carry on short USD positions. We look for EUR/USD to bottom at 1.02 in 1M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Medium-term (6-12M horizon): Implementation of new regulation will continue in 2017, which is likely to continue to put downward pressure on the US monetary base. Additional rate hikes from the Federal Reserve in 2017 (we forecast a 25bp hike in June and December) are likely to be less of a strain on the monetary base than before and after the rate hike in December 2015, as the hiking cycle seems better aligned now with a recovery in the natural rate of interest. If the Federal Reserve attempts to push rates higher at a faster pace, it may become an issue though. This will maintain a higher negative carry on short USD positions vis-Ã -vis EUR and Scandinavian currencies than can be explained by the spread in interest rates, e.g. the 3M EUR/USD basis spread should stay around the present 70-80bp. Over the medium term, we look for the USD to fall back on valuation and the beginning of a correction of the large US current account deficit. As implementation of new regulation moves closer to the end, it should furthermore be less of a supportive factor for the USD. We forecast that EUR/USD will rise to 1.12 on 12M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.