EUR/USD shot up and is trading on high ground. Has it stabilized here? Is it going to stabilize at all?

A lot depends on central banks. Here is Nordea’s take:

Here is their view, courtesy of eFXnews:

China and EM fears is currently triggering massive de-risking in global markets, leading to a substantial squeeze higher in EUR/USD. Inflation markets are currently screaming for both ECB and Fed to ease further. To us it makes sense for the ECB to “outdove” the Fed, but that depends on how much the central bank has changed under Draghi.

– Bad news for risk appetite still bad news for the USD

– Easing begets more easing – how dovish will ECB and Fed become?

-Near-term direction decided by China hard-landing fears

The USD has been on the back foot recently as China and oil worries have caused a big bout of risk aversion. Contrary to the correlations in the past, usage of the EUR as a funding currency – and changed equity hedging strategies – means that what’s bad news for risk appetite is good news for the EUR(and hence bad news for the USD).

The probability of Fed rate hike in September has slumped, in part due to a dovish read of FOMC minutes from the July meeting. Summing up the past few weeks the market has had to cope with softer messages from the Bank of England, the Federal Reserve as well as from the People’s Bank of China. This prompts the question on what central bank could be next. After all, easing begets more easing”¦

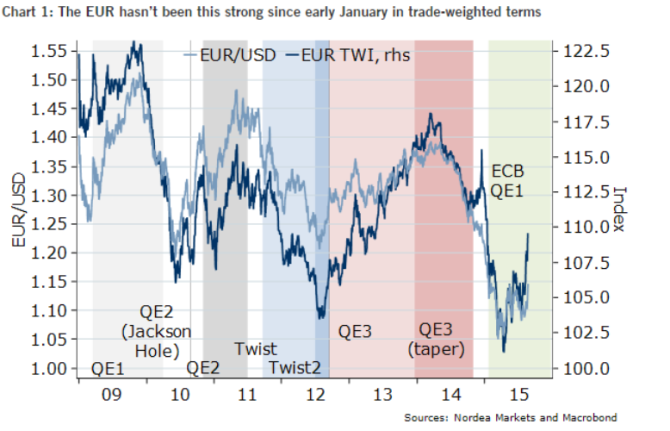

The ECB is facing: i) a substantially stronger (5%) currency than expected, ii) inflation expectations are much below mandate-consistent levels, iii) oil prices are 31% lower than ECB expected in July, iv) GDP growth is looking a tad wobbly, and v) a market that is pricing in four successive deflation readings in coming months. The ECB will need to cut its inflation forecasts materially, which means the market may get its (EUR-negative) stimulus hopes up ahead of the September meeting.

Our economists still call for a first small Fed rate hike at the September 17 meeting. Data will probably need to improve markedly, and stock markets need to bounce materially, if this is to be delivered. Weaker stock markets represent tighter financial conditions also in the US, and this is not offset by a weaker USD.

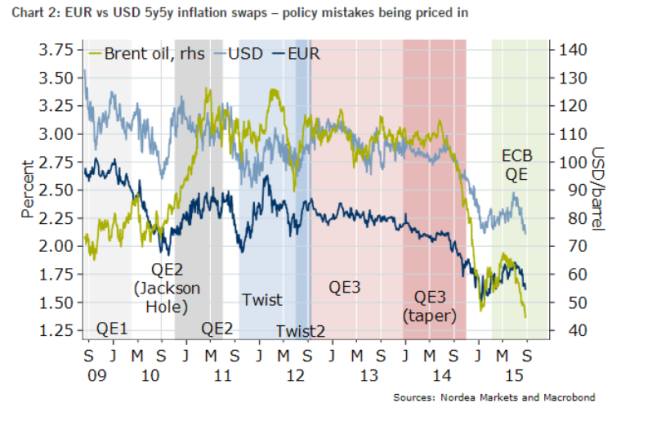

While EUR/USD has surged recently, the trade-weighted USD saw new YTD highs as recently as last week, and central banks such as the Fed tend to care much more about trade weighted indices than about certain crosses and pairs. Indeed, most of what applies for the ECB applies to the Fed as well (stronger USD than expected, lower inflation expectations – chart 2), albeit with some very important differences: US output gaps are closed. Inflation expectations are unanchored in the Euro Area, but not in the US.

One problematic fact for the USD bulls is however the relative track-record of central banks.The Fed is normally much more sensitive to changes in market conditions and is traditionally more pro-active than the slow-moving ECB (in short; the Fed tends to do its job better). It remains to be seen how much has changed under Draghi. Markets are currently screaming for both central banks to ease, as e.g. inflation is seen undershooting targets for years to come.

Barring any distinct central bank repricing, EUR/USD will continue to be affected by gyrations of risk appetite (chart 3).

If you think the global recovery remains firmly on track, and central banks will ease further (which should underpin risk appetite) then EUR/USD is a sell on rallies within a broader range: ~1.05-1.15 has held since late-January)

If risk appetite continues to worsen, and the market opts to bet in the direction of e.g. hard landing in China – this is what has been playing out recently in markets – then EUR/USD is likely to be squeezed higher as there are still a lot of USD longs to be unwound. In this scenario, we would consider establishing shorts around 1.17-1.18.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.