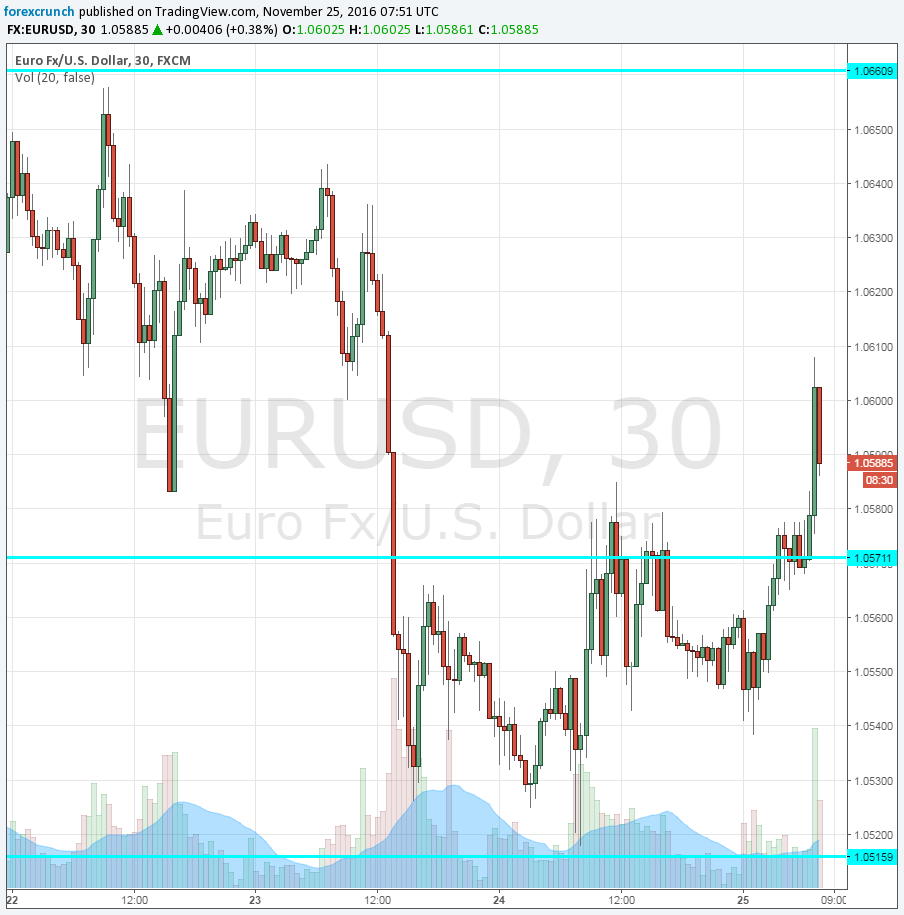

EUR/USD had already created a double-bottom at the December 2015 lows of 1.0520 and seemed entrenched in range, capped by 1.0570. However, the pair managed to rise all the way to 1.0608.

In the past, euro/dollar had a hard time staying in such low levels for a prolonged period of time, justifying the bounce. In addition, profit-taking can explain the move.

However, perhaps a report from yesterday evening has perpetuated. The ECB is reportedly having a hard time making a decision regarding the next moves. The QE program ends in March 2017. Mario Draghi and his colleagues have clarified that in they will announce the next steps in the December meeting.

But now, these reports talk about a chance of pushing back the decision to mid-January: the next decision by the Governing Council. Does this mean more QE? Tapering? Anything else?

For markets, it means uncertainty, and this could explain the jitters.

Lack of inflation implies pressure on EUR/USD

The 19-country currency bloc still encounters very low levels of inflation according to recent data: 0.5% in headline CPI and 0.8% in Core CPI. The latter hasn’t changed much. It is hard to see a sudden end to the 80 billion euro / month buying scheme. The debate is between tapering down the program or extending it at the same rate.

Given the low inflation, sluggish growth and the advantages that a resulting lower exchange rate has from more QE, there are good chances that the ECB lengthens the timeframe rather than beginning to wind it down.

So, given the monetary policy divergence with the US, there is a good chance that the downtrend resumes. Nevertheless, forex is never a one-way street.

More: EUR/USD parity – now or never

Here is the chart: