EUR/USD managed to stabilize itself on higher ground after mixed data but the pressure persists. Here is the view from Credit Suisse:

Here is their view, courtesy of eFXnews:

We lower our 3m EURUSD forecast to 1.05 from 1.10.

Rationale:

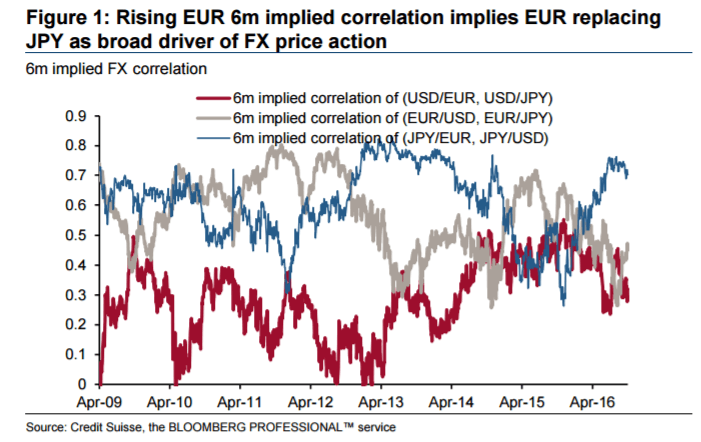

1. Relative monetary policy: The 20 October ECB meeting was interpreted as leaving open room for continued easy monetary policy, with no sudden tapering shocks seemingly in the pipeline. This contrasts with the apparent policy shifts underway in Japan and the US. Recent comments from ex-BOJ board member Shirai helped solidify a growing market suspicion that September’s BOJ move to cap rates was a first step towards winding down asset purchases in Japan. And in the US, the market seems willing to price in a December Fed rate hike despite suggestions from key officials like Yellen that they are still willing to look at the US economy glass as half empty. It seems rising inflation expectations and a tightening US labor market are enough to convince investors to continue leaning in favor of US rates trending higher.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

2. Politics: One reason we have been hesitant in recent months to be too USD bullish vs. defensive currencies like EUR and JPY was the risk that the US election leads to a populist victory and USD-negative uncertainty. With the likelihood now high that the US political leadership will remain conventional after the election, we are prepared to lower the required risk premium for the USD now. As for the EUR, we have argued many times that where GBP goes, eventually EUR has to follow. Quite simply, we do not expect the triggering of Article 50 combined with French, Dutch and German elections in 2017 to leave the currency unscathed. Political risks are diverging again, in favor of USD and against EUR.

3. Market reaction: EUR has underperformed all key G10 currencies so far in October with the exception of GBP. It has also underperformed a variety of EM currencies against a backdrop of seemingly “risk-on” markets, with crosses like EURAUD pushing through one-year lows. European equities, however, seem to be welcoming this, including bank stocks. In much the same way as UK equities have responded well to a lower GBP, the natural order of the moment appears to be that a lower EUR is both reasonable and beneficial.

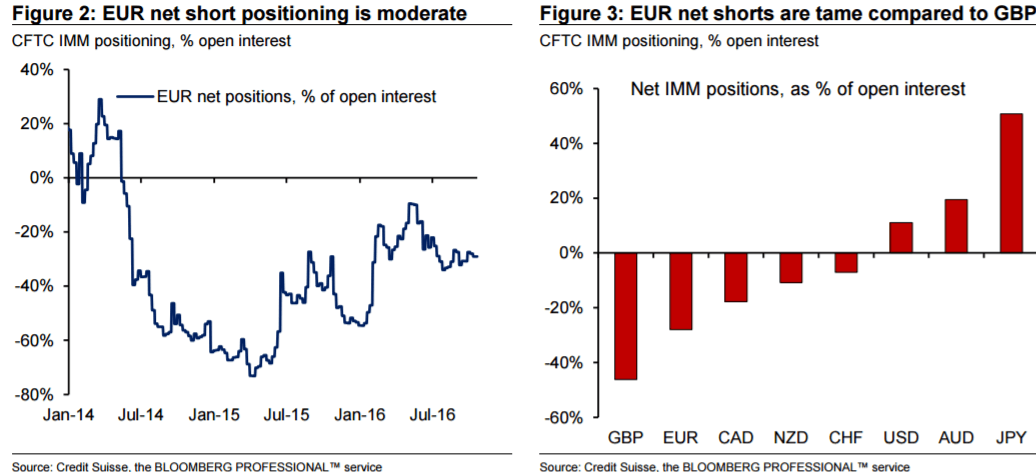

4. Positioning: Short EURUSD positioning is moderate at the moment, compared to early 2015.

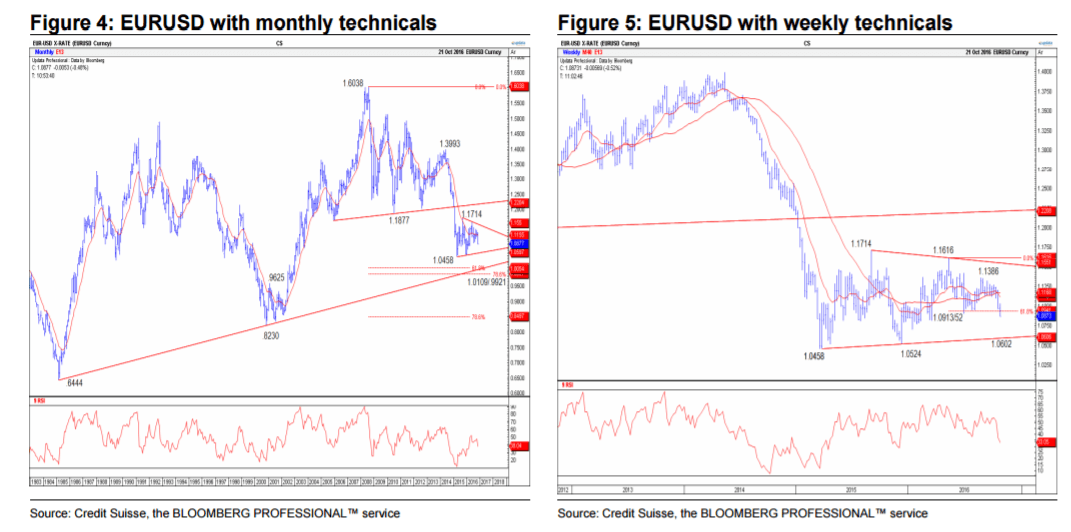

5. Technicals: Technically EURUSD’s breakdown below important support at 1.0952/13 – the 61.8% retracement of the December 2015/May 2016 rise and the June/July 2016 price lows – has reinforced an existing top and our bearish view. We look for further downside to 1.0826/22 next, then the January 2016 low at 1.0711. The bigger support area shows at the low end of the converging range and the December 2015 major low at 1.0602/0524, which we would look to hold. However, should the 1.0524 level be removed at any stage, this would suggest the broader range is being solved lower again for the March 2015 low at 1.0458. Beneath the latter level can open up a move to parity with long-term support showing at 1.0109/.9901 – a cluster of retracement levels and potential uptrend from the February 1985 low.

*As a technical based-trade, CS maintains a short EUR/USD position targeting 1.0615.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.