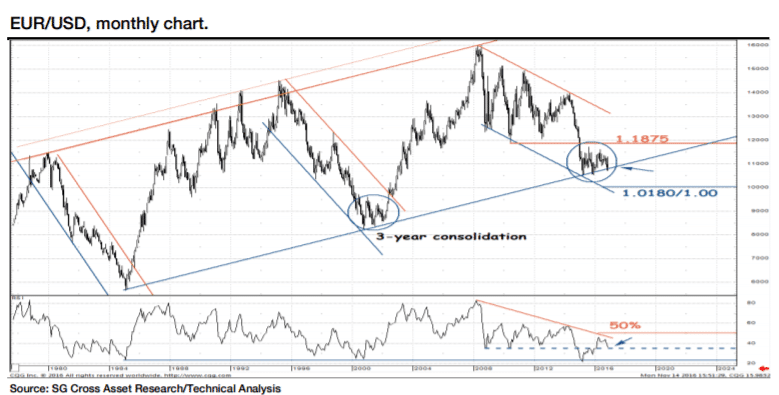

EUR/USD continues trending lower, hitting the 1.05 handle and has only two support levels left. The team at SocGen focuses on the downwards channel:

Here is their view, courtesy of eFXnews:

EUR/USD is trading comfortably below the multi-decade channel support (around 1.0780, monthly closing, pointed by arrow).

Only a definite break below the aforementioned channel would negate the base formation in place since March 2015 and the resumption of the overall down trend undergoing since 2008 peak. In such a scenario, the downtrend would fetch the previous lows of 1.0540/1.0465 and most importantly 1.0180/1.00, the 8-year down channel support and the 76.4% retracement of the 2000 to 2008 up move.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

At this stage, long-dated indicators (here monthly RSI) continue to hold an 8-year support line (in blue) and therefore emphasize pivotal supports are near.

Short-term, EUR/USD is approaching near the lower limit of the one and a half year range represented by the trend line undergoing since March 2015 and the 6-month down channel (1.0660/1.0610)

Daily Stochastic indicator depicts oversold conditions at the approach of a multi-year floor and suggests immediate downside to be limited.

However, it will take a break past the multi-month graphical levels of 1.0810/1.0860 and the 23.6% retracement of the fall since last August for short-term rebound signals to emerge.