EUR/USD managed to bounce back from the 9 year lows seen last week, but it is far from an “all clear” mode.

The team at Goldman Sachs note the long term wedge and the targets at very low levels:

Here is their view, courtesy of eFXnews:

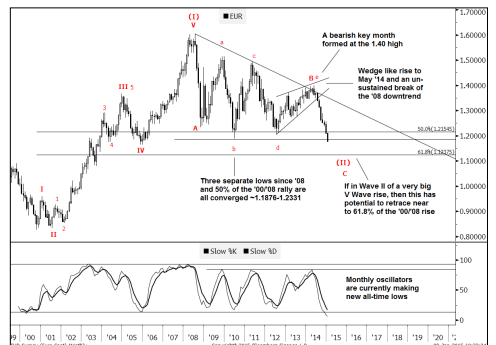

EUR/USD has now satisfied its L/T wedge target at ~1.20 (Jul. ’12 low), notes Goldman Sachs.

“It’s also gone through a series of three previous lows from ’08/’11/’12 all set near 50% of the initial ’00/’08 rally (~1.18-1.23) and so far there has been very few material corrections,” GS adds.

From an Elliott wave perspective, GS notes that EUR/USD eventually looks as though it could retrace ~61.8% to ~1.1237 and this decline would in turn complete a multi-year ABC (which began in ’08) and subsequently the second wave of a LT bullish sequence which originated in ’00.

“In short, 1.12 is likely the level to be watching for signs of a meaningful base,” GS projects.

Near-term, GS thinks that the next support appears to be 1.1598 as this level is derived as 2.618 times the length of wave 1 taken from the May 8 th high.

“If viewed as an extended wave-5, this might be the next plausible downside target having already exceeded the 1.618 target which was up at 1.2090,” GS argues.

“It’s hard to point out any sort of immediate resistance; ultimately ~1.20 will be a big physiological level,” GS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.