EUR/USD is struggling to recover from Draghi’s blows. What’s next for the common currency?

Here are two views and two target levels for euro/dollar:

Here is their view, courtesy of eFXnews:

Here is the view from Barclays:

“The ECB surprised markets last week, strongly hinting additional policy stimulus at its December meeting, when the committee updates its economic projections. We continue to think that a time extension of the PSPP program by 6-9 months is the most likely policy action this year.

As we have argued, proactive ECB action will likely act as a catalyst for a renewed push lower in the EUR, helping EURUSD break its multi-month range and re-instating some conviction in a renewed EUR downtrend.

A 10bp deposit rate cut, to which the market now assigns a 40% probability to happen in December, remains the most effective way to sustainably weaken the EUR, in our view, but is not our baseline case for 2015. Instead, we think it would be more likely deployed next year, following QE extension in December. The likely trigger for a deposit rate cut, in our view, would be a further material appreciation of the euro, possibly in a scenario where the Fed remains on hold for longer.

We continue to forecast EURUSD to depreciate to 1.03 by year-end.”

And here is the view from BNP Paribas:

BNP Paribas quant model ‘STEER’ continues to signal scope for a further EUR/USD decline with an estimated fair value of around 1.05.

“The decline in the eurozone front-end yields key driver of EURUSD. The euro 2y swap rate fell from +4bp to -3bp and our rates strategists see scope for a further decline to -7bp,” BNPP notes.

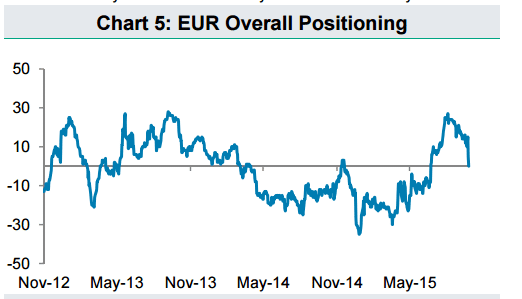

Moreover, BNP Paribas FX Positioning Analysis indicates that there is plenty of scope for EUR shorts to be rebuilt towards levels that prevailed earlier this year.

BNPP maintains a short EUR/USD position from 1.1450, targeting 1.09.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.