In June of 2014, the ECB began increasing its monetary easing policy by first lowering the overnight deposit rate to -0.10% followed by a second reduction in September of 2014 to -0.20%, where they have remained since.

The results of the low rate policy, plus the implementation of the monthly target of €60 billion in asset purchases have had mediocre results at best.

In the statement read by ECB President Mario Draghi at the 3 September post meeting press conference, Mr. Draghi noted that, “… the Governing Council decided to keep the key ECB interest rates unchanged... …the Governing Council… … emphasises its willingness and ability to act… …and recalls that the asset purchase programme provides sufficient flexibility in terms of adjusting the size, composition and duration of the programme... …The risks to the euro area growth outlook remain on the downside… …Notably, current developments in emerging market economies have the potential to further affect global growth adversely via trade and confidence effects…“

Guest post by Mike Scrive of Accendo Markets

As an indication of the ‘swing’ in the global economic outlook which has occurred this year may be seen in the optimism express by Mr. Draghi in his press conference statement introduction of 3 June 2015: “… we decided to keep the key ECB interest rates unchanged … …In the first quarter of 2015, real GDP in the euro area rose by 0.4%, quarter on quarter, after 0.3% in the last quarter of 2014. In recent quarters, domestic demand and, particularly, private consumption were the main drivers behind the ongoing recovery… …demand for euro area exports should benefit from improvements in price competitiveness…”

On the other side of the Atlantic during that same period of time, the situation was quite the opposite. As the year progressed the US Fed first, dropped its ‘patience’ policy and then signaled through inter-meeting speeches and interviews that the Fed would most likely begin to unwind its 0.00% to 0.25% target by June: “…“At this point, raising rates in June looks like the attractive option for me,” Federal Reserve Bank of Richmond President Jeffrey Lacker told reporters on Tuesday after a speech in Raleigh, North Carolina. “Data between now and then may change my mind, but it would have to be surprising data…”

San Francisco Federal Reserve President John Williams stated that the Fed was getting, “closer and closer“ to a rate increase. However, the Fed became indecisive as economic data began to indicate mixed signals about the continuing strength of the economy. In a regularly scheduled testimony to the US Congress towards the end of February, Federal Reserve Chair Yellen stated that the Open Market Committee would consider a change in policy “on a meeting by meeting basis“

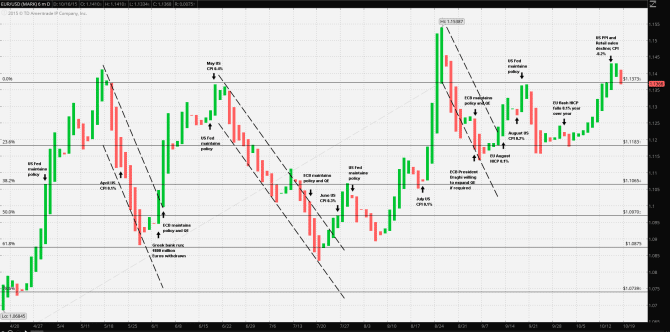

Over the past six months the USD saw its best vs the Euro in mid-April at $1.05669 to the Euro, but weakened over the next four months to a high of $1.15387 per Euro; over a 9% decline vs the Euro. As the price/event chart indicates, between the high and low the US Dollar strengthened sharply just prior to policy meetings. Needless to say, there were events during those four months which may have created a flight to quality trade. For example, the end of May saw a run on Greek banks with €800 withdrawn in 48 hours, coinciding with Euro weakening.

At the 16 July ECB post meeting press conference the ECB Governing Council decided to, naturally, leave rates unchanged and focused on the improving economy with the borders of the EU. However, the accelerating economic contraction in the Asia-Pacific may have been the motivation for several statements on the EU ability to expand QE. ECB Executive Board member Peter Praet was quoted, noting, “…Developments in the world economy and in commodity markets have increased the downside risk of achieving the sustainable inflation path toward 2 percent…“

The point of the matter is that the both the ECB and US Fed started the year confidently, each central bank having the expectations that their respective policy directions were on the right track: the ECB on the road towards more robust growth, in spite of the continuing Greek-EU impasse and the US Fed towards normalization. However, paralleling a line penned by the famous poet Robert Burns, “the best laid schemes o’mice an’ men oft go awry“; this seems to be the case here. With commodity prices deflating and China’s globally supportive economy contracting, advanced economies, either directly or indirectly, are beginning to feel the pinch.

The US Fed seems to have been put on the back foot after having confidently planned to ‘lift off’ the zero bound only having to delay in the wake of economic data well below expectations; the ECB suddenly has been put on the defensive after having planned to follow through with it QE program to 2% target inflation.

For at least the near term, it’s reasonable to expect the US Fed to maintain its policy, quietly. The Fed needs to regain its credibility. So far, expressing sentiment between meetings one way or the other, has only cause confusion. On the other hand, the ECB is clearly warning that it has more than enough leverage needed to continue to defend its recovery’s progress. This is a key point: Euro weakening, or its expectation, is bound to cause US Dollar strengthening so the impact of an ECB action will be twofold on EUR/USD.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“